09 Oct THE AD-POCALYPSE: MORE DARWININAN CULLING THAN A CATASTROPHE

That grave in the cemetery for the ad-supported media business model (in particular display advertising) will remain empty for a while longer, if not forever. A few years ago, a media agency CEO declared that it wasn’t a matter of the display banner ad being dead. In truth, he said, it had never really been alive. Ouch!

But he was wrong. It turns out that what ailed digital advertising wasn’t the format but the execution: Pathetic quality, overwhelming volume, visual cacophony, insensitivity to privacy, glacial load times, product irrelevance, and disruptive intrusion.

Today, smart media companies and advertisers are fixing all that: they are making high quality, compelling, relevant, privacy-protected, useful digital ads in a variety of new formats that load quickly and actually add value to the reader’s experience.

It’s the execution, stupid!

The realisation that it’s not volume but quality, relevance and engagement that count has contributed to the continued robust growth of global advertising.

Global advertising revenues grew by 7.2% in 2018 to reach a total of US$552 billion in the 70 countries analysed by strategic intelligence company Magna in its 2018 year-end report on global advertising market trends.

That’s the strongest growth rate since 2010, when the ad market recovered after two years of recession, and the second strongest since 2004, thanks to the combination of strong demand and cyclical drivers, according to the report.

Magna is not as sanguine about 2019, forecasting a 4.7% rate of growth. Publicis Group’s Zenith predicts 4% growth for 2019 while GroupM, WPP’s media investment group, projects a lower rate of 3.6%. The growth of digital advertising in particular will slow down in 2019 (+13%), but even at that slower rate, MAGNA predicts that digital media ad formats will still attract half of the world’s total ad dollars as early as 2019 or 2020.

However, even while ad growth continues, all is not well with the advertisers or the consumers.

GLOBAL ADVERTISING REVENUES GREW BY 7.2% IN 2018 TO REACH A TOTAL OF US$552B, THE STRONGEST GROWTH RATE SINCE 2010 — STRATEGIC INTELLIGENCE COMPANY MAGNA

Advertiser Dissatisfaction

On the advertiser side, the dissatisfaction is with the media companies. With consumers, the dissatisfaction is with the continuing presence of offensive, useless, intrusive ad formats, and that dissatisfaction is driving the continued (if slowing) growth in ad blocking.

At a time when you would have expected media companies to long ago have become intensely attuned to the needs of their clients, amazingly that is not the case. Or at least, that’s not how the clients feel.

Despite spending more money with their media company partners than ever before, advertisers are increasingly dissatisfied with those partners, according to a survey by business intelligence firm Advertiser Perceptions of 450 advertisers.

Only 60% of the respondents said they were happy with their media partners’ awareness of their budget and time constraints (down from 64% in a 2016 study). Slightly more than half of the respondents (57%) said they were satisfied with the CPMs of their campaigns (down from 62% in 2016).

Similarly, advertisers aren’t happy with media companies being proactive about optimising ad placements for best results (only 60%, down from 64%), nor did they feel their campaigns met their KPI goals (just 61%, down from 65%).

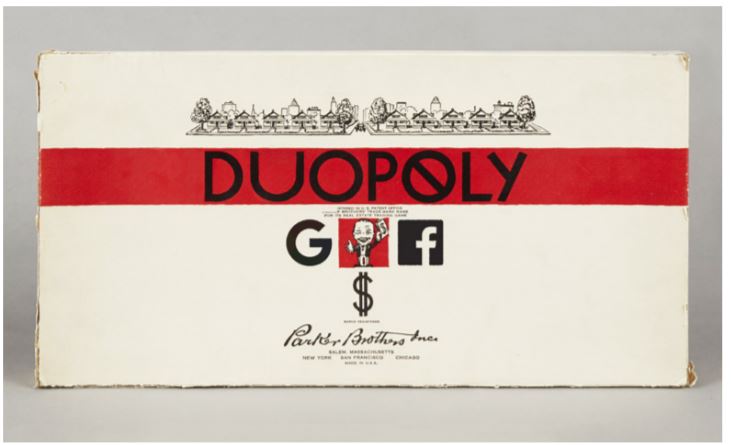

Duopoly dominance

And, while the continued growth of ad spending is good news, it is definitely tempered by the dominance of the digital ad market by The Duopoly (Facebook and Google). In 2018, the duopoly accounted for 57.7% of all ad spending, according to eMarketer.

But there is a sliver of a silver lining in that news: In 2017, the duopoly accounted for 63% and eMarketer projects that their share will drop to 55.9% in 2020. Much of the loss, however, is seen as going to Amazon (from 4.1% in 2018 to a projected 7% share in 2020), according to eMarketer.

“Facebook’s growth from national marketers is slowing, indicating that major brands are concerned with recent events there and are focusing on brand-safe environments,” Standard Media Index (SMI) CEO James Fennessy said this month in a statement. For media companies committed to the ad-support business model, then, they must figure out ways to thrive in the reality of a market dominated by two or, now, three big players.

How to compete with the duopoly

The best way to compete with the duopoly is to play to the strengths of media companies and take advantage of the duopoly’s weaknesses: Use branded content, promote brand safety, and invest in editorial.

Strategy #1: Branded content

“Facebook and Google offer distribution, but they have no editorial expertise,” said Lindsey Guenther, Executive Vice President of Strategy and Partnerships at Remedy Health Media, writing on eContent.com. “Publishers, on the other hand, have the audience and expertise to develop and distribute high-impact branded content.”

“Spending on branded content is expected to hit US$16 billion in the US this year, according to PQ Media,” she said. “That means branded content is growing twice as fast as advertising and marketing overall. One reason for this is that brand recall for branded content is 59% higher than standard advertising, according to a 2016 IPG MediaLab study. The study also found that consumers perceive branded content as being more consumer-centric than standard advertising.”

Strategy 2: Promote brand safety

“For Facebook and Google (including YouTube), brand safety continues to be a challenge,” Guenther wrote. “Despite efforts by both to assure marketers that their brands won’t be exposed to unsafe content, advertisers remain sceptical. A survey this year [2018] of 304 advertising decision-makers found 58% were more concerned about brand safety in 2018 than in 2017.

“That explains why publishers are having such success with brand safety pitches,” she wrote. “During the NewFronts this year [Interactive Advertising Bureau’s annual series of presentations], many publishers reported that advertisers were raising their spends for that reason. Digital video publisher Studio71, for instance, has seen a five-fold increase in deals, year-over-year, since it introduced a brand-safety product, according to CEO Reza Izad.”

Strategy #3: Invest in editorial

“Savvy publishers are investing in editorial to ramp up on quality and stand out,” wrote Guenther. “In a time when fake news has become a major hazard, readers have realised that brands matter in publishing, too. Publishers, meanwhile, know that their product is under more scrutiny than ever before. Both pressures require an investment in top talent.”

Not everyone hates ads

Even in the face of increasing ad blocking, there is a sizeable portion of the reading and viewing public that prefers “free” ad-supported content. For example, more than two-thirds of consumers globally have streamed live video and slightly more than half of those people (52%) say they prefer free, ad-supported video to subscription-based video, according to a 21-country study by the Interactive Advertising Bureau in 2018.

Nonetheless, those same consumers would really like it if we cleaned up our advertising act.

“Fine-tuning media buy and campaign assets to ensure these encounters are seen as different and relevant, as well as being creatively engaging, is a must to capitalise on what previously-seen consumption metrics show is a captive and growing audience,” the report stated.

The much-maligned banner ad

That fine-tuning should begin with the old workhorse: the display ad. Innovative display ads are still relevant if backed by the right strategy, according to advertisers.

“It’s not right to say the display ad doesn’t work — it has its own merit if done right,” global agency Isobar Executive Vice President Gopa Kumar told Best Media Info. “It helps you reach a wider variety of audience. If targeted well and with good context and creative, it’s bound to do its job of engaging and inducing an action from a consumer, which is its primary task in the first place.”

“Display advertising is not just a medium for placing ads, but we look at it as a reminder medium,” digital agency Foxy Moron Co-Founder Pratik Gupta told Best Media Info.

Giving display ads new life

Two media companies, among others, have taken on the challenge of defining the banner ad: The New York Times and Bloomberg.

In 2016, The New York Times introduced its own version of the banner ad, a proprietary platform called Flex Frame. The new units not only dynamically adjust to fit the screen, but they also replace the traditional teeny banner ads with full-bleed, in-stream units that run down the entire page and are responsive to the page’s width.

In just two years, FlexFrame units grew to make up almost half of all display units sold, NYT VP/Ad Innovation Allison Murphy told Digiday. FlexFrames perform better, too. On the NYT’s new article page, the FlexFrame click-through rate is double what it was on the old article page, and in eye-tracking tests, users paid four times more attention to the FlexFrame ads on the new story page versus the old page, Murphy said.

“There’s less distraction on the page, and that was part of the philosophy: Be more intentional about what you’re offering users,” she said.

Bloomberg’s new take on banner ads

In 2018, Bloomberg took a crack at redefining the display ad. Called Ad.apt, it takes all of an advertiser’s assets such as photos and videos and content, and mashes them up into one of four ad variations featuring those assets along with data and/or relevant Bloomberg stories. Ad.apt then tailors each ad to each viewer based on that viewer’s ever-growing browsing history.

“It’s about driving more impact in a more efficient way,” Global Head of Ad Trafficking, Technology and Product Derek Gatts told Digiday.

The advantage Bloomberg brings to this kind of targeted banner ad is its treasure trove of data about its readers that can be used to customise the Ad.apt ads. Bloomberg can create different formats and then, as the reader interacts with it, they can tweak the creative from headlines to button colours. “We’ll be able to say, this type of headline resonates with a CEO whereas a CTO resonates with this type,” Gatts said.

The Ad.apt ads are sold both directly and programmatically. This initiative also has the added benefit of reducing the company’s reliance on external ad tech, something many media companies are trying to do.

Ad innovation: Not the equivalent of treating a corpse

Despite banner ads being declared dead as a doornail long ago, they actually and overwhelmingly outperformed native ads in terms of post-install engagement on Android, the dominant platform in developing markets, according to the inaugural Creative Ad Index report by mobile user acquisition firm Liftoff.

The report analysed 273 billion ad impressions across 4.5 billion clicks, 63 million app installs, and more than 22 million post-install events in more than 1,200 apps between November 2017 and October 2018.

It turns out that banner ads, at $3.73 per post-install action, are the best value for Android systems. Banners are 22% less expensive than native ads ($4.55 per action), and they deliver a higher ITA at 38.1% (compared to native at 35.8%), according to the Liftoff report. (ITA is “Install to Action”: A ratio of the number of installs of an app compared to the number of users that take a specific defined action, according to Liftoff. For example, a 10% registration ITA means that 10% of all downloads resulted in a registered user.)

More engaging formats

Despite the resurrection of banner ads in new formats, the future is to be found in more engaging approaches, including native ads, content integration, and content marketing.

Even if banner ads are getting better, they will still fall victim to ad blocking software and be wasted on the millions of online readers who install blockers.

“Both advertisers and publishers are now looking for various ways to beat ad blockers,” Isobar Executive VP Gopa Kumar told Best Media Info. “So native ads, content integration and content marketing are gaining prominence. Also with [fewer] ads and the push for quality inventory, I see the CPM or prices of the ad units going up.”

The Washington Post is a leader in creating new, ad-blocker resistant, engaging, useful ad formats.

One of their solutions is called “Showcase”, which is an event recommendation ad unit that combines an advertiser’s message with things like recipes and ticket sales. The targets for this format are real estate, entertainment, and sports advertisers. The format includes a feed of coming events and a purchase button linking the reader to the advertiser’s site.

“You hear users don’t like ads,” Jeffrey Turner, Head of Ad Product who oversees the Post’s Research, Experimentation and Development (RED) team, told Digiday. “They respond very well to good ads, but it’s bad ads that are bringing down the industry. A brand doesn’t want a negative experience for a user. So it’s the value exchange we’re really after. RED’s done a great job initially around making light, fast-loading ads. Now, we’re thinking about how the user can engage and interact with the ad.”

The Post expected to grow ad revenue in the double digits in 2018 for the fourth year in a row, and they expected RED to play a part by building ad products for the video and branded content divisions that are expected to power the Post’s ad revenue growth this year, Post Chief Revenue Officer Jed Hartman told Digiday.

“RED is driving a good share of growth, by being embedded throughout the organisation,” he said. Since its inception, RED has rolled out 20 products such as customisable native ads and PostPulse, which shows readers a carousel of Post articles that the advertiser chooses.

Advertisers can hand-select articles for ad placement

In mid-2018, Hearst Newspapers launched a pay-per-article technology called SolidOpinion that enabled advertisers to hand-select the stories they wanted their ads to appear near. The ad, a text-based format called “Promoted Headline” appears right above the story’s headline.

The way it works is advertisers get to pick keywords as well as the type of news they want their ads to appear with. But it’s not automatic. Advertisers must bid on specific topics and locations. If they win, their ad appears whenever an article matching their keywords and topics appears.

This is exactly the kind of environmental control the advertisers want. The old system allowed advertisers to bid only on a specific page, like the home page, without knowing what types of stories were going to be there. “I have had advertisers ask me ‘can I be on the home page only when there’s happy news?’” Fergal Carr, Senior Vice President of Consumer Product at Hearst Newspapers, told MediaPost.

Targeting emotions and opinions

Another ad approach designed to increase the utility or at least the compatibility of ads for potential customers is a system News Corp is employing in the UK called NewsIQ UK.

Advertisers can now plan, optimise, and audit their campaigns using data from the media company’s reader behaviours databank, including the types of stories they read, enabling targeting based on emotions and attitudes.

News UK, owners of the Sun and The Times, is positioning the tool as a way for advertisers to drive “emotional loyalty and advertising engagement” and move away from click metrics to measuring success by awareness and attention metrics.

For example, a travel advertiser can choose readers with a preference for outdoor adventures whose opinions also have been identified as valuing exclusivity and have responded positively to adventure stories.

To help advertisers try the new system, News UK cited a London School of Economics study that found readers of a highly emotional story are 45% more likely to then complete a neighbouring video ad. The study also found that readers of “pleasurable” stories were 32% more likely to view the entire neighbouring video ad.

“NewsIQ UK builds upon the traditional approach to digital advertising by recognising that audiences are people, driven not just by who they are and what they do, but also by what they think and feel,” Ben Walmsley, Digital Commercial Director at News UK, told MediaPost.

“Preferences, opinions and emotions are fundamental factors in driving behaviours and the ability to identify these states and then build campaigns around them is going to change the way that advertisers communicate with audiences,” Walmsley said.

The number one smartphone activity outside of work

If advertisers are looking for the most direct route to consumers, it’s in-app advertising, The number one smartphone activity outside of work is in-app shopping, and 82% will “consult their phones on purchases they are about to make in a store,” according to a Google study.

As a channel, mobile apps have an inherent appeal to marketers, and yet most brand advertisers don’t allot proportional resources when considering the time spent in-app, according to Yoni Argaman, Senior Vice President Corporate Marketing and Strategy at global tech company Fyber, writing on MarketingLand.

“In-app has come a long way,” wrote Argaman. “It has already caught up to the web in terms of traffic quality and is rapidly catching up in terms of campaign measurement. But there’s one gap that may never be closed, and that is a gap where apps actually have the upper hand — consumer mindshare. In-app is where the consumers spend most of their time, which is why brand marketers interested in the mobile channel must advertise there.”

Another new frontier: Messaging apps

“Advertisers must follow the mantra of going where the customer is,” Jerry Canning, Vice President of Digital Sales at cinema advertising company National CineMedia, told Digiday. “No doubt that monetising messaging will continue to be a focus area as digital advertising continues to spread its wings and follow platforms where customers are spending their time.”

“People spend more time on messaging apps than they do on the mobile web, and mobile web is US$10 billion in US ad spend.” — Alex Magnin, head of revenue, Giphy

Messaging apps including Twitter, Snapchat, and Facebook Messenger have ad formats built into the messaging experience. Even GIFs and stickers can be branded. Facebook, which claims it facilitates 10 billion messages a month between users and businesses, offers ads in Messenger and in its chatbot offerings as well.

“We’re having conversations with every major advertising category and really when we think about this space, it truly is enormous. People spend more time on messaging apps than they do on the mobile web, and mobile web is US$10 billion in US ad spend,” Alex Magnin, GIF-maker Giphy’s head of revenue, told Digiday.

This review of new ad formats barely scratches the surface of innovation in digital advertising that’s happening at media companies around the world. Suffice to say, as long as readers and viewers want access to “free” content and advertisers want access to those people, digital advertising will do just fine, thank you very much… with one caveat: They must stop abusing those customers and continue the trend of delivering advertisements that add value to reading/viewing experience.