06 Feb CHILL! BLOCKCHAIN ISN’T GOING TO ROCK (OR WRECK) YOUR WORLD TOMORROW…

…but keep an eye on it for the not-too-distant future

It’s safe to say that blockchain and Bitcoin and all that other crypto-stuff has a lot of media executives’ knickers in a serious twist. Relax.

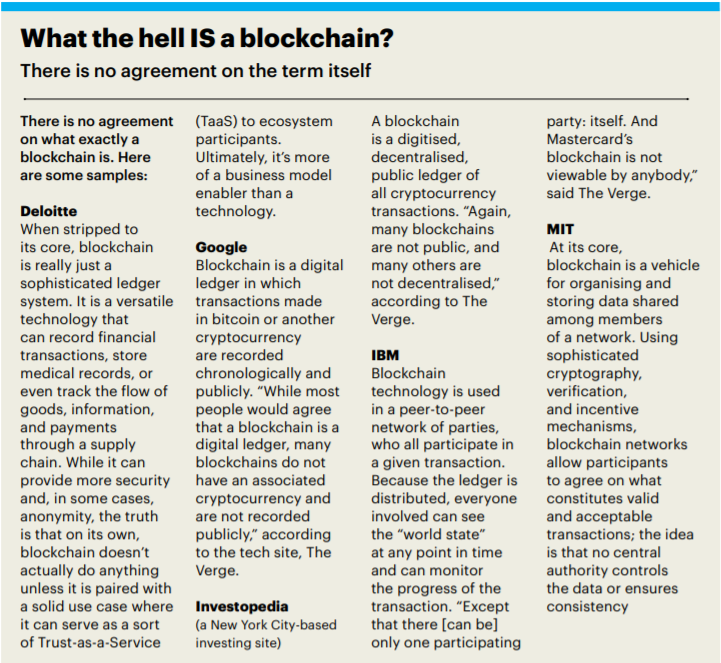

Even if you don’t know what any of those terms mean, there’s no need to panic. But you really should educate yourself and keep your eyes on the whole blockchain, cryptocurrency thing because it could have a significant impact on your business. Or not.

Most of us have heard of Bitcoin and the irrational explosion in its value followed by its sudden and devastating near-obliteration. At the end of 2017, Bitcoin had skyrocketed more than 2,500% from its 2017 low to reach a new high of almost US$20,000 by that December. A mere 12 months later, 80% of that value had evaporated, almost $700 billion worth, much of it in just the one month of November, according to coindesk.com.

The new year has not provided any relief. As of late February 2019, Bitcoin, for example, had stagnated slightly below its November 2018 low of $3,879 at a value of $3,804.

That kind of extraordinary, giddy instant wealth followed by an equally instant, massive financial cataclysm not only lends itself to big headlines but also to serious misunderstandings.

At the height of Bitcoin’s gold rush in 2017, 59% of UK consumers polled said they’d never heard of blockchain technology, according to UK-based bank HSBC. Furthermore, 80% of those who had heard of the tech said they didn’t understand what that was.

After a year of dramatic news headlines, another survey in mid-2018 found awareness had increased, but not understanding. Almost 80% of American respondents had heard of at least one type of cryptocurrency by then, according to a survey by polling firm YouGov. But of that group, 87% had not mined, bought or sold cryptocurrency, and half did not plan to purchase bitcoin in the future.

Worse, only 17% of respondents thought cryptocurrencies were mostly used for legal purchases!

In media company boardrooms and editorial and sales departments, there is a different kind of confusion, not dissimilar to the early internet days. But this time, executives worry about missing the next big thing, even if they don’t see how it applies to their business.

“I don’t see a killer app for blockchain in the media space,” Nick Rockwell, Chief Technology Officer of the New York Times, told FIPP. But then he left himself some wiggle room: “There’s some potential for establishing provenance for media assets, but it’s not clear that that will make a difference. A working decentralised identity system based on blockchain would be pretty interesting for media as well as for many other use cases, but I don’t know if one will emerge.”

He’s hardly alone, and, it turns out, he’s right. For now.

“While early adopters — those digital enterprises and emerging disruptors that have built their businesses around blockchain from the very beginning — are quickly moving their blockchain efforts from their corporate test beds to production, enterprise digital (legacy) organisations are not moving at the same pace,” wrote the authors of the 2018 Deloitte Global Blockchain Survey.

“Nor should they be,” the study declared. “While these organisations can’t afford to ignore blockchain, or its potential to disrupt the way they’ve done business for decades or even centuries, they also don’t need to feel pressured to ‘keep up with the Joneses’ by adopting new business solutions before they’re ready to do so.

“Having a healthy fear of disruption is fine, but there’s no need for legacy organisations to feel anxious and move toward blockchain without first identifying and developing a solid use case,” they concluded.

That is music to many media executives’ ears.

But Deloitte also warned: “In short, the only real mistake we believe organisations can make regarding blockchain right now is to do nothing. Even without a completely solid business case to implement, we believe that organisations should, at the very least, keep an eye on blockchain so that they can take advantage of when they present themselves.”

“Based on our view of where blockchain is today and, more importantly, its likely adoption rate within the next three years, we strongly believe that organisations need to evolve their thinking around the technology,” the report projected.

“We see blockchain enabling a completely new level of information exchange both within and across industries. As connections are made between blockchain and other emerging technologies, particularly the cloud and automation, we see the potential for blockchain to help organisations create and realise new value for businesses beyond anything we can imagine with existing technologies.”

One way media companies can keep an eye on blockchain developments and their potential for media business models is to acquire or invest in a blockchain company.

For example, one media company acquired a minority interest in a blockchain start-up created by another media company. In late 2018, Swiss media group Ringier acquired a minority interest in the Berlin start-up Bot Labs, which was founded in January 2018 by Hubert Burda Media together with Ingo Rübe, the former CTO of the national publishing company at Burda. Bot Labs develops blockchain-based technological innovations for companies and offers cooperative models.

“With the help of Bot Labs, we are aiming to better understand the potential of blockchain technology and to learn how to exploit it for the digital assets in our portfolio,” Robin Lingg, Head of Marketplaces at Ringier, told FIPP. “As a digital media company — one that is family-owned, like Hubert Burda Media — we need to continue to successfully drive forward Ringier’s digital transformation. In addition to investing in companies, we see investments in enabling technologies as investments into the future of our group”.

“Blockchain technology has the disruptive power to eliminate intermediaries,” Board Member Philipp Welte, who represents Hubert Burda Media as a shareholder of Bot Labs, told FIPP. “For publishing companies like us, it offers a major opportunity to liberate the connection to our consumers from the clutches of monopolists and to utilise the value created by our content in the digital world for its true purpose: financing high-quality journalism.”

Another way to stay on top of the blockchain industry would be to join or create a blockchain consortium. “In the near term, we believe that blockchain consortia will continue to gain traction,” wrote the Deloitte study authors. “According to our survey, approximately 29% of our respondents have already joined an existing consortium, with nearly 45% saying they are likely to join one within the next year.

“As blockchain gains traction and influence, we believe the benefits of consortia, including their shared costs, ability to create unified industry standards, and advantages of scale, will make them even more attractive options for companies in finance, technology, and health care over the next two to three years,” the authors wrote.

Some media companies are already using blockchain. Researchers at MIT in the US looked at how media and entertainment companies are using blockchain and reported their findings in the autumn 2018 edition of the business school journal Sloan Review.

The researchers examined more than 1,100 start-ups attempting to develop blockchain-based business models in a range of settings in addition to media and entertainment companies, including health care, telecommunications, energy, retail, aviation, real estate, and supply-chain management.

In a telling — and perhaps cautionary — summary, the authors found that, “so far, there has been no significant impact on the respective markets in terms of revenue and market share, but managers’ and investors’ expectations for future returns are high, as indicated by the flow of money into blockchain start-ups.”

Looking specifically at media and entertainment companies, the researchers found that “some experts think blockchain may increase the share of revenue captured by content creators and producers by introducing new mechanisms for monetisation.”

The team looked at blockchain-enabled businesses in 20 start-ups in the US, Europe, the Middle East, and Asia all using blockchain to manage or monetise digital content in music, TV and video, publishing, social media, video games, and digital art.

The researchers found three primary models and two others not as widespread:

1. Smart property: Many companies are starting to use “smart property” to track and enforce rights for creators of digital content, including music, video, books or articles, or even art.

2. Micropayments: Another popular application, cryptocurrency, facilitates micropayments to content providers. Companies use it for enabling customers to buy and play single songs or videos, for instance, or to purchase permission to read a news article.

3. Smart contracts: This is used to enforce license terms and dispense payments in financial transactions. For instance, it could allow certain digital content to be published and downloaded at a defined time and price — and could then split the payout among content creators.

Some less common applications of blockchain included:

• Blockchain time-stamping: This allows photographers and other creators of digital artwork to register proof of copyright quickly and inexpensively so that they can protect their creations from unauthorised use on the internet. Time-stamping is a simplified version of smart property. It doesn’t track ownership changes, but it does confirm that the creator-owned the asset at a specific point in time.

• Blockchain content ledger: This records digital content information like asset metadata and social media transactions. It is a direct extension of smart property. Indeed, once a blockchain is used to store ownership information, it can also be used to hold additional information about the content. In the case of social media, it might include user posts and related activities such as “upvoting,” “downvoting,” and comments.

“By leveraging the blockchain applications we’ve described, companies are starting to build innovative business models that not only offer new monetisation strategies for their digital assets but also streamline critical business activities such as relationships with business partners and distribution of revenue across the value chain,” wrote the authors.

“These developments could create completely new ecosystems for content creation and consumption,” they wrote. “Because the underlying blockchain technology is not sufficiently mature to handle billions of users and millions of content titles, start-ups are not yet able to challenge established mass-market players like Facebook, Amazon Prime, and Netflix.

But that’s partly what makes the new models serious threats: Industry leaders might not recognise them as threats in time to protect themselves. As the technology matures and the blockchain-enabled start-ups begin serving broader segments of customers — with a wider range of content, for instance, or ad-free social media environments — look out.”

Clearly, the tech community believes passionately that blockchain will “revolutionise everything”, said FIPP CEO James Hewes. “The question, however, remains if blockchain will be a back-room technology that will improve processes or a consumer-facing technology that will actually add value to a product or a service.”

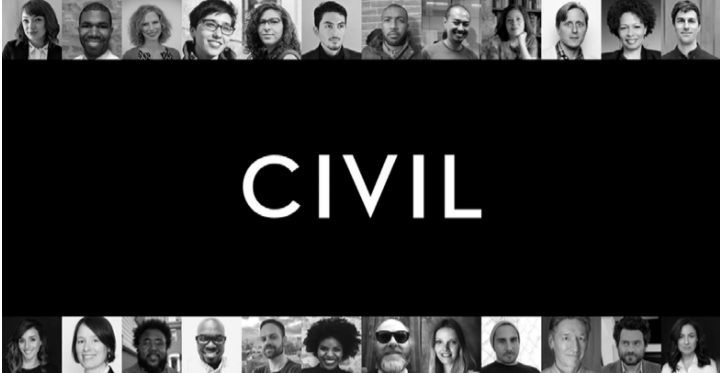

One use case for blockchain in media was dealt a very public and very dramatic blow in October 2018 when the blockchain-based Civil Media Company’s Initial Coin Offering (ICO) failed spectacularly.

The company’s goal was to sell between US$8m, and $24m in crypto-currency called CVL tokens to consumers who would then use the tokens to support a network of newsrooms operating outside of the “failed” ad-supported media model across the US.

The mission of the company is to “power sustainable journalism” via a “decentralised model based on blockchain and crypto-economics,” according to the company.

“We believe that the ad-driven business model is slowly killing good journalism — which is itself a critical foundation for free, democratic societies,” wrote one of Civil’s founders, Matt Coolidge, in a company blog post. “So, we’re introducing a new model.”

“We even think that we are going to be able to show people that it’s more fun, it’s more rewarding, to pay for the news using CVL tokens as opposed to cash,” Civil CEO Matthew Iles told The New York Times.

The one-month sale began in mid-September but by its close in mid-October, only 1,012 buyers had purchased a mere $1.4m of the hoped-for $8-$24m in tokens. Even worse, of the $1.4m in tokens sold, 80% were purchased by ConsenSys — the blockchain software company that underwrote Civil in the first place.

“It was as if an Olympic weight lifter said that, at a minimum, he’d be able to clean and jerk 400 pounds, and then did not manage to move the bar more than an inch off the ground,” intoned the New York Times.

“Look, we sometimes get asked, are we too early?” Iles said. “And the answer is absolutely yes. But you only are ever going to be too early or too late.”

Timing might not be the problem for Civil.

“Still, a problem remains: People don’t buy into blockchain applications unless they can make money,” wrote Jonah Engel Bromwich in the New York Times. “There is no evidence that people want to use it to ‘fix’ journalism. There is also no evidence that anyone really understands how that would even work… The technology remains difficult to comprehend, and, for any news consumer’s purpose, irrelevant.”

Another highly touted token-based publishing platform start-up aimed at the media industry, Po.et, enticed the Vice President of Innovation at The Washington Post, Jarrod Dicker, to leave the Post to become Po.et’s CEO in February 2018. The company was founded to reward content creators, establish a clearer path for monetisation, and verify the provenance of media posts using the bitcoin blockchain. Po.et is a “decentralised protocol for content ownership, discovery and monetisation in media,” according to Dicker.

“Po.et is an open source project and it’s at the protocol layer with code libraries that different companies, from independent publisher to larger corporations, can use in different ways,” Dicker told BlockchainBeach.com. “The notion that we could impact and influence by building part of ‘the next internet’ felt like a once-in-a-lifetime opportunity to do something great in a field I absolutely love.

“We’re building something that is going to be used by many people in very different ways,” he said. “When you look at the attribution component of being able to timestamp and attribute content, that is really focused on the Internet of Permanence. That’s a concept which was supposed to be in the value of the web, but isn’t anymore.”

“The biggest thing I’ve noticed is that in blockchain, there are people who are ‘Rowdy’ or people who are ‘Dowdy’, and that’s it,” he said. “There are either people like us who are saying ‘This is it, it’s the future’ and then there are people saying, ‘This is shit; it’s a scam.’”

Less than a year after he started, Dicker quit Po.et to return to The Washington Post to a job created for him: Vice President of Commercial Technology and Development.

Shortly before he left, Dicker had to announce the layoffs of five of Po.et’s employees. (The Po.et layoffs came after a string of layoffs at other crypto companies, including SpankChain, Steemit, and ConsenSys.)

“We built a team that aimed to drive at 100mph all the time,” Dicker wrote on a Po.et blog after he announced his departure. “The reality is that we’re facing a long road to adoption… What does 100mph really accomplish other than tickets, accidents and extra gas? Maybe the way to mature as a technology isn’t to be the quickest one to finish but rather the longest in the race. That is something we as a company need to realise in order to make the most impact.”

Blockchain proselytisers are prone to categorical and, one could argue, preposterous statements.

Consider their ironclad assurance that blockchains are un-hackable:

January 2018: “The beauty of blockchain technology is that it enables a digital marketplace that is both decentralised yet tamper-resistant. Transactions are recorded chronologically in a distributed ledger that is transparent to its participants but encrypted so nobody can cheat by changing or faking transactions. Agreed business rules, logic, and contract terms can also be programmed to automate transactions, known as ‘smart contracts’. — Nelson Ganados, Executive Director of the Institute for Entertainment, Media, Sports and Culture at Pepperdine University

January 2019: Hackers gained control of more than half of the blockchain exchange on Coinbase and rewrote transaction history, enabling them to spend the cryptocurrency on the exchange more than once (called “double spends”). While US$1.1m was threatened, the hacker did not take money (perhaps satisfied to just show he could). But a second attack on another popular exchange — gate.io — cost that company $200,000 (but the hacker returned half of it days later).

In all, blockchain exchanges previously thought to be un-hackable actually have been hacked to the tune of US$2b since 2017, and that’s just the amount revealed publicly, reported Mike Orcutt in MIT TechnologyReview.

“These are not just opportunistic lone attackers, either. Sophisticated cybercrime organisations are now doing it too: Analytics firm Chainalysis recently said that just two groups, both of which are apparently still active, may have stolen a combined $1 billion from exchanges,” wrote Orcutt.

“The very nature of public blockchains means that if a smart-contract bug exists, hackers will find it, since the source code is often visible on the blockchain,” he wrote.

The supposed impervious nature of blockchain was one of the reasons its advocates saw it as the future. Now, not unlike ad fraud, it sounds like a race for blockchain programmers to get and stay ahead of the hackers.

So, what should media companies do about blockchain and cryptocurrency?

The advice from Deloitte rings true. Their caution against irrational exuberance and the blind pursuit of the next shiny thing makes sense. Watch, perhaps invest in a blockchain start-up, investigate blockchain consortiums, and examine your business practices and workflows for areas where blockchain could make a difference.

But don’t write it off. We’ve made that mistake before.