13 Aug Micropayments: guess what! This might be the time they finally deliver new readers and revenues

Let’s admit it, shall we? There is no single hidden super solution waiting to be discovered that will solve all the publishing industry’s revenue and readership problems.

What is out there is a veritable buffet of attractive mini-solutions, each contributing incrementally to a new publishing business model that will be much more stable and sustainable than the old single-legged stool (advertising) we relied on in the past.

Publishers are beginning to successfully replace lost print advertising revenues with income streams from new forms of advertising (native, video, and programmatic), events, e-commerce, e-newsletters, niche products, e-books, audio, data products and services, branded content, consulting, editorial services, and, the subject of this month’s column, micropayment systems.

Micropayment systems will be one of those attractive innovations that will help solve our circulation and revenue problems. Micropayments alone are not the sole solution, but they will deliver both new revenues and new readers.

Critics are quick to cite numerous micropayment missteps and failures going back to the early 1990s when companies like FirstVirtual, Cybercoin, Millicent, Digicash, Internet Dollar, Pay2See and others failed. And then a little later, companies like Beenz, BitPass, and Peppercoin appeared and disappeared.

“Guess how many times it [a micropayment system] has been successfully tried in the past 17 years?” asked Ink, Bits and Pixels editor and owner Nate Hoffelder in June in his company’s The Digital Reader blog. “If you guessed zero, you would be correct.”

OK. Point taken.

But does early failure predict ultimate failure?

While micropayment systems don’t rise to the level of historical impact as the automobile, would anyone care to guess how many automobile companies failed in the formative years of that industry (1890-1915)?

Three hundred and eighty-one. In the United States alone. You can look it up.

What puzzles me about the critics of micropayment systems is their persistent pessimism, even in the face of proven success. When Hoffelder wrote his piece (9 June), he was predicting the demise of an already successful micropayment operation in The Netherlands called Blendle. And Hoffelder was not alone in his doubt.

And yet…..

As we speak, tens of thousands of Dutch readers are using micropayments to purchase individual newspaper and magazine stories, and more do so every day (an estimated 5,000 new micropayment users a month). In just fifteen months, Blendle has attracted 360,000 users (up from just 130,000 in October 2014), of whom 20 per cent are using the micropayment option. Together those payments already amount to more revenue for Dutch publishers than Apple is delivering (an admittedly low bar).

“We’re proving that people do want to pay for great journalism,” wrote Blendle founder Alexander Klöpping in a medium.com one-year anniversary piece. “The goal: put all newspapers and magazines in the country behind one (quite sexy) paywall, and make it so easy to use that young people start paying for journalism again.”

According to Klöpping, the Blendle brainstorm was the answer to these“what if” questions:

- You could read all the journalism you care for in one place

- You would only need to register once to read all of what you do want

- You would only pay for the articles you were interested in and actually read and liked

- You’d get your money back if you didn’t like the story

- You wouldn’t be pressured to subscribe

- You wouldn’t be bombarded by ads

The brainstorm has translated into a micropayment model that works, delivering new revenue and new readers to Dutch publishers.

“But more importantly: It’s money from people who weren’t paying for journalism before,” wrote Klöpping. “My friends had never paid for music and movies, until Spotify and Netflix. And with Blendle, they’re paying for journalism, often for the first time in their lives.”

Here’s how it works: Users submit their payment details once (and only once) when they register and then, for each story they choose to read, a small fee is deducted from their account at the end of the month. If they don’t like the story, the fee is immediately refunded.

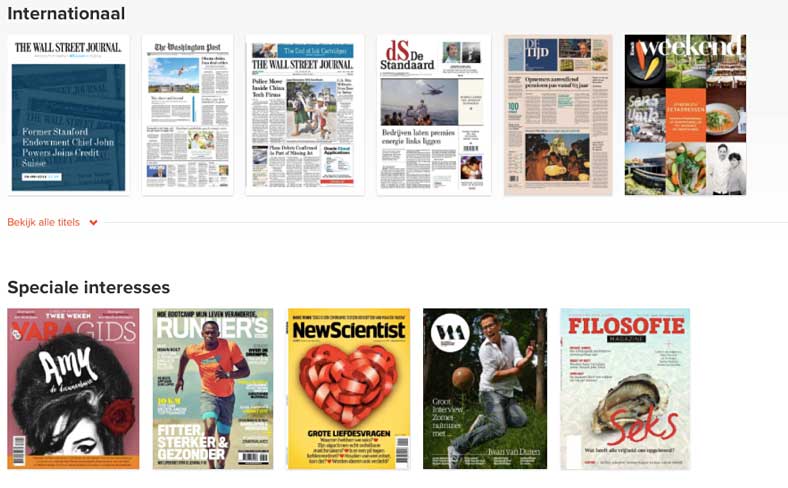

Blendle users see a feed that is a combination digital newsstand and friend-feed: stories curated by Blendle editors about the topics the user is interested in and trending stories, plus stories recommended by friends or celebrities and public figures.

Publishers set the price (the average story costs twenty US cents). The publishers and Blendle split the revenue with 70 per cent going to the publisher.

But as important as the revenue is the fact that, according to Klöpping, the “vast majority” of Blendle readers are under the age of 35, the very group publishers are having trouble attracting and desperately need in order to survive as they watch their core readership age and, well, pass away.

Why does it work? It’s not just the ease and convenience of the micropayment system — it’s the golden triangle of choice, convenience, and curation, Klöpping told The Media Briefing. “What makes Blendle work in the end is that triangle between having a filled catalogue with all the major newspapers and magazines in a country that you’d expect; having one log-in, one registration that makes it easy to pay for everything [and] being able to find the content that is most relevant to you [though curated topics],” Klöpping said.

What have the founders learned? Klöpping says they’ve learned four lessons:

Even in the face of that success, Hoffelder’s headline was: “Blendle Will be the Next To Show That Micro-Payments Still Don’t Work”. And an INNOVATION colleague of mine, former Schibsted and Liberation editor Frédéric Filloux, headlined his 2 November 2014 “Monday Note” blog post: “The New York Times and Springer Are Wrong About Blendle”. (The NYT had recently signed a distribution deal with Blendle.)

To a person, the critics say the micropayment system is doomed not because of price or even technology, but because of a phenomenon computer scientist Nick Szabo coined in 1996: Mental transaction cost. His theory is that consumers go through great angst trying to decide if something is worth buying or not. The critics also cite internet consultant and writer Clay Shirkey who wrote in 2003 that that mental transaction cost ironically increases as the price drops.

Maybe so. But times and consumer behaviours change.

Indeed, the same Clay Shirkey critics enlist to debunk micropayments wrote in a 1 June Tweet about Blendle: “This is the first interesting micropayments idea I’ve seen in 15 years”.

Micropayments plus an Instant Refund option: https://t.co/S0fPFvn1jQ This is the first interesting micropayments idea I've seen in 15 years

— Clay Shirky (@cshirky) June 2, 2015

It would seem that Blendle may have finally found a way to minimise consumer angst. Maybe it’s the initial creation of an account against which to draw, or the low cost, or, more likely, the satisfaction with the product and the building of a habit of buying the same or similar products that have made the reader happy each time.

Or maybe it’s the money-back guarantee. How much angst can there be if you know you can get your money back if you don’t like what you bought? The initial purchase is not a commitment, it’s a conditional commitment. In essence, readers can postpone the final purchase decision until after they’ve “consumed” the product and found it satisfactory and worth the price. Or not.

As one Blendle reader wrote on The Digital Reader in June, “You choose to read an article, and yes, you pay for it, but there is no continuous conscious choice for me if I want a refund for each of these articles I read.”

While some publishing company accountants might blanche at the thought of giving money back, Blendle’s experience is that only four to five per cent of its customers ask for a refund.

The Blendle founders point out that refund requests tend to come from readers of gossip and click-bait type stories. They suggest that in addition to new revenues and readers, micropayment systems will actually encourage high-quality journalism rather than the empty calories of click-bait content.

Not everyone is a critic. As a matter of fact, multiple major publishers are getting behind Blendle’s unique micropayment system. The Washington Post, The New York Times, The Wall Street Journal and every single one of Germany’s major newspaper publishers are now on Blendle (not just a few major German newspaper publishers — ALL of them: 18 dailies and 15 weeklies).

Two major media companies are also putting their money where their mouths are: The New York Times and German publisher Axel Springer SE invested US$3.8 million in Blendle in October 2014.

The investment helped fuel Blendle’s expansion into Germany; the founders say France and perhaps the United States are next.

Micropayment company CoinTent is also bullish: “Just as we’ve seen with music, movies, and game content, people are willing to pay for quality articles that they’re interested in reading if the price is right and the purchase experience is simple,” CoinTent CEO Bradley Ross said. Ross believes that young people have been acculturated to making small and instant purchases for mobile games and in-app add-ons.

The success of micropayment systems such as M-Pesa in Africa, India, and Eastern Europe has given US and Western European tech and publishing companies additional courage to replicate their systems.

Two publishers in North America, The Winnipeg Free Press in Canada and Milwaukee Magazine in the United States, launched micropayment systems this summer. It is too early to tell how those initiatives are faring (scroll down for a short story about Winnipeg).

And in Europe, Nordic media giant Bonnier AB and micropayment company Klarna are partnering to offer Bonnier readers the option of a one-euro daily pass, and will soon offer individual stories for small sums.

Still need convincing? The Dutch readers themselves have nothing but high praise for the system:

“I'm one of the 'didn't pay for newspapers before' and right now spend a couple of euro's a month on Blendle. Articles cost between € 0,10, and € 0,50. If you buy so much articles from one paper/magazine that it is cheaper to get the whole edition, you get the whole edition. Refunds work perfect. You don't like the article -> click -> money back. No questions asked.” — birger (April 2015)

“Much like birger, I never paid for any of the 'paywalled' news outlets before. Mostly due to the terrible user experience, t&c, and lack of content (often single newspaper/magazine). Even though I find most content in newspapers not even worth reading, let alone paying for. I do really want to pay for some high quality articles and Blendle makes this possible.They nailed it for me with the money back option, truly no questions asked. The pre-paid wallet makes me comfortable in that I don't feel tricked/lured into some subscription or other form of overpaying. Overall very smooth UX, no annoying crap. Makes you wonder why so many websites still try to nag me into paying when it only drives me away from them … Much enjoyed. Keep up the good work! — mvdwoord (April 2015)

“Before Blendle, I only used paywalled sites that I had a physical subscription for. It was horrible (only the Economist worked as expected). Watching magazines and newspapers implement their own solutions was just painful... some Dutch newspapers did an awful job with apps … Blendle provides both an excellent user experience and a good solution to content providers who should really not be making their own apps.” — furyg3 (May 2015)

So, let’s see: Who should we listen to? The critics citing old failures and old psychological studies, or the readers who are happily handing over money to read content a la carte in ever-increasing numbers.

Give me a minute.

Seems to me, it’s worth the effort. If it works — and it appears to be doing well already — we’ve got another incremental source of revenue and, more importantly, a nose under the tent of the content consumption world of the under-35 age group.

Count me as a believer.

You?