13 Nov How to Stop Churn and Retain Reader Revenue after the Covid Subscription Bump Now is the time to consolidate the gains.

As difficult as the last two years have been with office work being disrupted, print sales declining and ad sales being unstable, it was also a golden age of sorts for publishers when it came to the promise of building a sustainable digital business model around revenue. Traffic and interest in news surged as people turned to trusted sources for information in uncertain times, and they proved they were willing to pay for quality journalism. It was a moment, a perfect storm, that seemed to accelerate years of steady growth in digital businesses. People were used to paying for subscription services like Netflix and Spotify and had the time and money to take on more.

Consider the numbers: In 2020, subscription revenue for publishers grew 16%, according to a study by subscription management platform Zuora, while another report by Piano, another subscriptions management platform, indicated that their largest clients saw an increase of almost 58% in subscribers over the first year of the pandemic. Encouragingly, they were also a bit stickier. One year into the pandemic, 43.6% of post-pandemic subscriptions were retained vs. the pre-Covid average of 40%.

For the bigger names in publishing, record subscription levels were recorded. The New York Times grew by 52%, while The Washington Post managed more than 66%. In the UK, both The Telegraph and The Economist saw record growth. These are the usual suspects of course, but there is also evidence from outside of Western newsrooms. The International News Media Association reported, for example, that after 19 years in the market, the online news portal Malaysiakini in Malaysia saw its subscriber base grow by 64%, with total reader revenue up by 70%.

HOW LONG CAN IT LAST? You’ve got the subscribers to come on board, but how do you keep them? Toward the end of 2021 we already started seeing growing signs of pandemic fatigue and people logging off from digital consumption habits. Writing for The Fix in March 2022, Jakub Parusinski noted that “the past few weeks have seen huge drops from such companies as Netflix, Meta (a.k.a. Facebook) and the home fitness equipment maker Peloton.” The latter in particular seemed to tell a larger cautionary tale about how business models built on pandemic-era digital consumption habits were perhaps set for a worrying decline. The competition for people’s time and money is just becoming much more intense.

For publishers and news organisation, as the roller coaster news cycle of 2020 recedes further into the rear view, there are worrying questions to contend with: how many subscriptions can a reader keep and pay for, especially if they are returning to the real world and not spending all that time at home to consume content. More importantly, which category of news organisation might be affected by this trend? We know that the bigger newsrooms may have collected more dedicated readers who would probably stay on, and these organisations have resources to invest in audience research and strategy to get subscribers to stay. But what of smaller local and regional news outlets? Could drop-offs in subscriptions upend the foundations on which publishers around the world are hoping to move to a sustainable model of reader-revenue?

Before we dive into the best strategies for subscriber retention, let’s first try to get some insight into why people cancel news subscriptions.

Over the course of 2021, the Harvardbased Nieman Journalism Lab ran a survey amongst its readers, asking one simple question: What was the last news subscription you cancelled, and why? Surveys like these are crucial and frankly, we have too few in our industry.

“Public data on cancellations is sparse. It’s not something that news organisations like sharing. So we asked our readers for their most recent cancellation stories, and received over 500 responses,” Nieman Lab noted.

Of course, the caveat here is that a Nieman Lab reader is probably more into news than the average person. Many of the respondents therefore, indicated they are paying for more than one news subscription, which is not the norm.

Here’s what the survey found:

The No. 1 reason people say they cancel a subscription is money: Nearly a third of respondents — 31% — cited money as the primary reason they cancelled a subscription. Some people cancelled when promotional rates expired; others were irritated that subscriptions auto-renewed or that news organisations weren’t transparent about price. Respondents cited a lack of funds, often due to the Covid-19 pandemic and related income loss, as another reason for cancelling subscriptions.

This is followed closely by ideology or politics: 30% of respondents said that they cancelled the news subscription due to ideology or politics. The publications that were most often implicated in this line of reasoning were The New York Times and The Washington Post, but other publications weren’t exempt.

The content isn’t good enough: 13% of respondents said they’d cancelled the subscription for what we categorised as non-ideological content concerns: They thought a publication had become too clickbaity or non-substantive, or found that the content generally wasn’t useful to them or just wasn’t worth paying for.

Too much to read, too little time: Another 13% of respondents said they’d cancelled because of information overload; in the case of print publications, they

saw them piling up unread. (This was a common reason cited for cancelling The New Yorker.)

Customer-service issues: Finally, 12% of respondents to our survey said they had cancelled primarily due to some kind of customer service

or UX issues. Print newspapers were getting delivered too late (often, these people switched to online-only), or changing a subscription was so

annoying that the subscriber decided it wasn’t worth it.

ORGANISATIONAL STRATEGIES So we’ve drawn out the contours of the challenge that lies ahead for publishers. Now what are the different ways in which to tackle it?

Firstly, at an organisational level, it is time to invest in staff and strategy focused around keeping and bringing in subscribers. An August 2021 report by Digiday highlighted some examples of larger publishers that have made additions or changes to their leadership ranks to keep their subscriber momentum going.

“On Aug. 16, Michael Ribero took on the role of The Washington Post’s first chief subscriptions officer, tasked with overseeing the company’s digital subscriptions business,” the report notes. “Karl Wells was promoted to a new role at Dow Jones, chief subscriptions officer, in April, and he will have three new VP positions reporting to him starting this fall: VP of WSJ Core Subscriptions, VP of Barron’s Group Subscriptions and VP of International and Young Audiences.”

Others, the report notes, are investing in large teams to improve specific functions. The L.A. Times for example, is using first-party data “to inform creative messaging and perform content tests with specific user segments. In the last year, the publisher has hired “around 10” people each to its creative services and growth marketing teams to support its subscription strategy, including designers, copywriters, acquisition marketing managers, retention marketing managers, a media director and media planners,

among others. It is expecting to grow these teams as the challenge of retaining subscribers grows through the year.

STRATEGIES AROUND CONTENT AND AUDIENCE You’ve built up your team of crack subscription managers. Now what do you get them to look at?

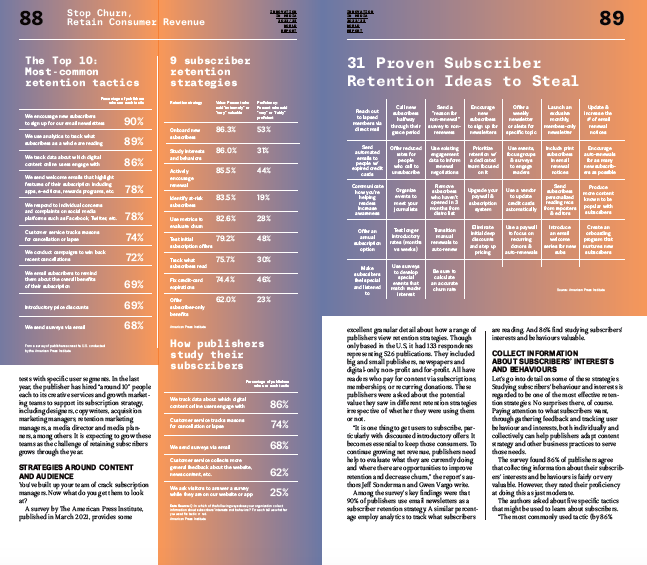

A survey by The American Press Institute, published in March 2021, provides some excellent granular detail about how a range of publishers view retention strategies. Though

only based in the U.S, it had 133 respondents representing 526 publications. They included big and small publishers, newspapers and digital-only, non-profit and for-profit. All have readers who pay for content via subscriptions, memberships, or recurring donations. These publishers were asked about the potential value they saw in different retention strategies irrespective of whether they were using them or not.

“It is one thing to get users to subscribe, particularly with discounted introductory offers. It becomes essential to keep those consumers. To continue growing net revenue, publishers need help to evaluate what they are currently doing and where there are opportunities to improve retention and decrease churn,” the report’s authors Jeff Sonderman and Gwen Vargo write.

Among the survey’s key findings were that 90% of publishers use email newsletters as a subscriber retention strategy. A similar percentage employ analytics to track what subscribers are reading. And 86% find studying subscribers’ interests and behaviours valuable.

COLLECT INFORMATION ABOUT SUBSCRIBERS’ INTERESTS AND BEHAVIOURS Let’s go into detail on some of these strategies. Studying subscribers’ behaviour and interests is regarded to be one of the most effective retention strategies. No surprises there, of course. Paying attention to what subscribers want, through gathering feedback and tracking user behaviour and interests, both individually and collectively, can help publishers adapt content strategy and other business practices to serve those needs.

The survey found 86% of publishers agree that collecting information about their subscribers’ interests and behaviours is fairly or very valuable. However, they rated their proficiency at doing this as just moderate.

The authors asked about five specific tactics that might be used to learn about subscribers “The most commonly used tactic (by 86% of the respondents) is to track what content is being read online by subscribers. That practice is nearly universally employed by most types of news publishers, with the exception of the smallest newspapers (of whom still a majority, 67%, are employing),” they write.

The least-used tactic is asking readers to complete a survey (only 25% do this). “This low response could be due to technical obstacles real or perceived which is keeping organisations from using this approach to learning,” the report notes. Online-only, for-profit publishers were more likely to employ most of these tactics, while the smallest circulation papers are less likely to use any of these methods for learning about subscriber behaviour. There’s one exception here: small papers are actually more likely than

others to have their customer service departments track the reasons customers didn’t renew (83% vs 74% of all publishers).

Let’s try to broaden out this point now by bringing in further nuance. In attempting to understand their customers should publishers focus on heavy or light users?

UNDERSTANDING THE “LIGHT READER” An important research paper published by the International News Media Association (INMA) in September 2021 titled “Light Readers: Digital Subscriptions’ Next Growth Path”, identified this latter category as representing the strongest growth path for subscription-mature news media companies and the audiences they really needed to devote resources to understanding.

The report acknowledges at the outset that this might be counterintuitive. More engaged or heavy readers, after all, will account for more a publication’s revenue. However, the report argues that this is a cohort that doesn’t really need to be understood — “They tend to be the people most like us. Heavy news consumers, as the segment name suggests, visit frequently and read many articles. Because of this, they are far less likely to churn than the light readers.”

So who is the light reader and how can we understand their importance in the larger rubric of subscription strategies?

“The longer you’re in the market with your subscription product, the more light- reading subscribers you are going to have, writes Grzegorz Piechota, INMA’s researcher-in-residence and the report’s lead author.

“The latest data from Piano shows that, in real-world situations, the majority of conversions come from light readers. The proportion of conversions that come from this cohort

grows the longer that you are in the market. In the first month of your subscription offering, 33% of your subscribers will be on their first active day of the month. By the end of the first year, that will be 37%, and the proportion of heavily engaged readers converting will be dropping — because more of that cohort have already converted.”

In fact, if we look at subscriptions overall, Piechota says, the majority come from light readers — and many subscribers do not read you at all. That’s the harsh truth of the matter for publishers to deal with. Recent research by Northwestern University’s Medill Spiegel Research Centre in the United States, based on a data analysis of 45 markets, found that nearly half of digital subscribers didn’t go to the websites they had paid for even once a month. In news industry slang, they are known as “zombie subscribers”. The infrequency of web visits was especially common among people with combined print and digital subscriptions, but a fifth of digital-only subscribers also were counted as “zombies.”

“The industry has long been concerned about unengaged subscribers, but the extent of the problem has not been widely known. An article on the Betters News website drew gasps by reporting that the Arizona Republic was facing a 42% “zombie” population when it started a subscriber retention campaign a few years ago,” Mark Jacob writes for while.”

IDENTIFYING AT-RISK SUBSCRIBERS EARLY How did the Gannett-owned Arrizona Republic, the state’s largest new outlet, deal with this problem? As mentioned, the publication realised that almost half of its paid digital subscribers were not visiting their website at all in a given month. They found that the group also accounted for

50% subscription stops each month.

The Republic thus went on an active mission of “killing” off these zombies, which, in this case, doesn’t mean getting rid of them but bringing them back to life as engaged subscribers. For nearly a year, the outlet tracked how content was performing with the various audience groups — new visitors, prospects, and subscribers. It used those learnings to guide content changes that cut the share of unengaged subscribers from 42% to 26%, increasing retention as a result.

Here’s an example, quoted in the Better News article: “…we are talking about being strategic about topics, headlines, photos and writing style. We found that the most successful zombie-killer stories in the newsroom were those that had strong news elements combined with a bit of a hook — a unique spin on a viral story, a strong human element, or a format that grabbed readers quickly. And, most importantly, one not written on the print deadline. Don’t wait to hit publish. Verify. Write. Publish.”

The Republic has become an often cited case study, but as Sonderman and Vargo write in the API report, this strategy of identifying at-risk subscribers was one of the biggest areas where publishers could improve their tactics.

Publishers tended to rate their proficiency at identifying at-risk subscribers as “not very” or only “somewhat” proficient. More than half (52%) of publishers are “not very” or “not at all” proficient at identifying at-risk subscribers. “This suggests that one of the biggest technological needs for publishers is to implement more sophisticated and integrated CRM software that links all subscribers’ identities to their digital engagement. This would enable publishers to see which subscribers are NOT signing in or visiting their products,’” the report notes.

Such technology would also help model systems to study churn propensity. “Which behaviour patterns by a given subscriber should cause a publisher to worry that a customer is likely to cancel a subscription? To learn that requires the technology to trace subscribers’ behaviour backward in time after they cancel subscriptions and find patterns in that behavioural data.” Once again, the API study found that larger news organisations are more proficient at doing this than smaller ones.

OTHER STRATEGIES TO ENGAGE AND RETAIN LIGHT READERS: Circling back to the INMA report, Piechota notes that the phenomenon of zombie subscribers is not exclusive to the U.S. Across more than 300 news publishers globally, Piano found that 39% of paying subscribers didn’t visit once in the month in question. The INMA report gathered more best practices from publishers around the world in order to establish a set of recommendations for converting and retaining light readers. These are as follows:

HOW TO ENGAGE AND RETAIN LIGHT READERS

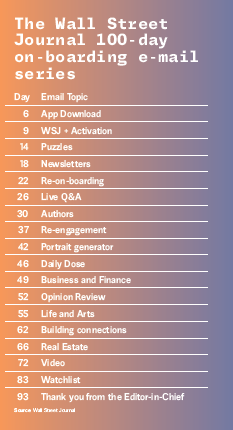

- Get new subscribers up to speed “Research suggests you have about 100 days to engage new subscribers,” Piechota writes. “The benchmarks show most new monthly subscribers churn in their first three months. This is the key window of opportunity for you to intervene to make them a more committed subscriber. If you can boost their engagement, they are less likely to churn.” One publisher that deploys this principle is the Wall Street Journal, which in 2019 created a cross-functional team to identify what specific user actions by new subscribers within their first 100 days indicate likelihood to renew their subscription. The effort was nicknamed “Project Habit,” and it identified some intuitive actions like subscribing to a newsletter or downloading an app, but also things like loyal consumption of a particular topic or author, reading recurring features such as a weekly column, and reading features stories beyond finance or politics. The Journal then turned that knowledge into churn-reducing action, building an onsite boarding experience that Piechota says remains the longest and the most comprehensive among the top 50 leading news subscription sites. The new subscriber is invited to swipe more than a dozen cards presenting benefits, helping to set up features, or asking to customise the experience. Despite the length, Anne Powell, director of engagement at The Journal, told an INMA Master Class on Digital Subscriber Retention that 60% of readers complete the whole flow. And up to 80% take at least one recommended action. The Journal has also extended its welcome emailseries to 93 days, which is also one of the longest series observed in the news industry. 100 days is an estimation, but it may not be the most exact window. “Research conductedby University College, London (UCL), suggests people are most likely to adopt new habits after 66 days of repetition,” Piechota adds. “So, you need to do something to engage the new subscriber daily for two months to start establishing your product as part of their habitual routine.”

- Study the light reading subscriber

A point similar to The Arizona Republic case study we highlighted. Whatever the strategy used, Piechota writes that it is particularly important to study the user behaviour of your light-reading cohort, as they are the ones you are most likely to lose. As an example, Karl Oskar Teien, product director for Aftenposten in Norway, tells Piechota that has established a project team focused on how to engage this light reader cohort. It looks at article types, but also at homepage structure. “We often curate homepages on the assumption that people are visiting the site every hour. That’s simply not the case for most readers. In fact, most subscribers rarely visit,” he says. “Is there a homepage structure that suits the occasional visitor? Of course. There are a number of approaches you can apply. If your CMS and publishing systems support personalisation by cohort, you could create variations of the front page, dependent on your segments. The light readers could see more evergreen, explainer, and news analysis content, while the heavy readers get the more traditional news-centric page.” - Adjust your product for light readers

“Once you understand light-reading subscribers, you need to adapt the product to their needs — without undermining its value to the heavy readers,” Piechota writes. This is a bit of a balancing act but there’s evidence to support the fact that light reader-centric changes are more likely to help with heavy readers than hinder you. Louise Story, a former chief product and technology officer for The Wall Street Journal in the United States, told INMA: “Topics attractive to light-reading subscribers of The Wall Street Journal succeed with heavy readers, too. It doesn’t work the other way.” Almost by definition, light-reading subscribers are more selective in what they read on the Web site than heavy users. An example that Story cited is that light readers might display a preference for practical advice about personal finance. “This is also useful for the heavy reader. Investing in more content in this space, or from better quality journalists, could bring the benefit from increased engagement from both cohorts and reduce your risk of churn.” As the Wall Street Journal found, the reverse is not true. Article types or topics that over-index with heavy readers do not often appeal to light readers. - Brace for “hop-on, hop-off” riders

A “hop-on, hop-off” behaviour pattern among media subscribers has been noted by Piano, which records that a growing number of purchasers disable auto-renewing right after they subscribe. 68% of auto-renew disablements are in the first 60 days of a new contract. 22% of the disablements now happen on the day of the purchase. This is comparable with behaviour seen in other subscription-based spaces, like TV streaming. An October 2020 study by Deloitte showed the average U.S. TV viewer had five

streaming video subscriptions. However, 46% of viewers had cancelled at least one streaming subscription in the last six months. “People are growing accustomed to having many services, but hopping on and off them as they see their value grow and decline. It’s a new kind of behaviour for the news subscription market, but we should expect to see more of this as we more actively pursue casual readers,” the INMA report notes

- Price to acquire — but also to retain

During the COVID-19 crisis, Piechota notes in the report that publishers that offered trials outperformed those that did not in terms of acquisition. “It is evident that trials work. But we need to construct them in such a way that they retain well instead of acquiring new subscribers who rapidly churn away. Some of the most successful publishers using trials have discovered a counter-intuitive approach that seems to work: offer much longer-term trials,” the report notes. Some 37% of publishers offer trials of three months or less, and 24% keep them to one month or less. However, The New York Times was offering U.S. readers a discount of 75% for a year ($1 per week instead of $4.25). The Washington Post was offering a 60% discount for a year ($40 instead of $100).” Since the start of the pandemic, The Boston Globe regularly promotes an offer of $1 per week for six months — and only then do you go to the standard rate. These are very long trial periods, and it may be counterintuitive, but they pay off better in the long run. “It’s simple: They buy you time to engage subscribers. It’s not the long trials themselves that deliver the results; it’s what those long trials facilitate. If you use that time to engage the reader and help them build a habit of using your product, they can deliver excellent results,” Piechota notes.

THE BIG AND SMALL NEWSROOM DIVIDE Given the range of newsrooms covered in the API report we are able to get some indication of the kinds of strategies for retention that the majority feel fairly comfortable deploying, and others which they feel are important but lack the technical resources to execute. And despite the survey being restricted to the U.S. it could give us some clues in this regard about disparities between small and big publishers in other markets as well. 87% of publishers for instance, place at least a fairly high value on welcoming, engaging and onboarding new subscribers. They also rated themselves as fairly and somewhat proficient.

This is an important strategy because subscribers are more likely to renew if they are aware of all the benefits of their subscription and feel personally connected to the publisher’s brand. Almost all publishers surveyed (90%) encourage subscribers to sign up for their newsletters and 78% send a welcome email. A smaller percentage send educational information about how to use their products (46%) or send personal notes from a person in the newsroom (43%).

Similarly, with encouraging digital subscribers to renew, most publishers felt moderately confident, with strategies centreing around responding to individual concerns and complaints on social media and conducting marketing campaigns to win back recent cancellations, reminding them of subscriber benefits.

The gaps appear in areas which require more advanced analytics. For instance, while many publishers acknowledge that an introductory discount is one of the best ways to bring in new subscribers, they understand very little about what kinds of initial promotions will lead to subscribers you can actually retain after the trial expires. “On this subject, as was true with identifying at-risk subscribers, the large newspapers are more proficient than are smaller newspapers or online publishers. In the most extreme case, a majority of online-only for-profit publishers say they are “not at all proficient” at this,” the report notes.

When it came to tracking content that subscribers engage with to build personalisation and give each customer unique recommendations or experiences informed by their past behaviour, publishers in the API study ranked themselves overall as mid to low in their proficiency.

Only 4% said they were “very” proficient but they did think it was highly valuable to track what content subscribers engage with.

ADVANCED TECH AND METRICS Depending on your organisation’s resources, there are solutions out there that can help with these strategies. The Times and Sunday Times in the UK for instance, invested in an AI technology for personalisation – a “digital butler” called JAMES, developed by the software company Twipe. Through automatically creating and sending individualised newsletters with JAMES, the publisher observed a 49% decrease in churn. During the project, JAMES served over 100,000 subscribers of

The Times with individualised newsletters, using several optimisation algorithms including time optimisation, content recommendation, and format optimisation. “What made the experimentation with JAMES different from other personalisation research is its unique focus on news content. Outside of the news industry, there’s been a lot of great work on personalisation, such as the strong recommendation engines from Netflix and Spotify, Mary-Katharine Phillips, Media Innovation Analyst at Twipe told INMA.

Now let’s look at the use of metrics to evaluate customer journeys and predict churn. The API report highlights the importance of having such a system in place for publishers – having the right metrics at hand can help to spot problems quickly and monitor improvement. However, just 6% of publishers said they were very proficient at measuring churn. Most (83%) agreed it would be a very or fairly valuable thing to do well.

Interestingly, 60% of respondents wanted to calculate the Lifetime Value for their digital subscribers, meaning the total amount of money a customer is expected to spend not just this year but in their lifetime. This is a metric that balances current prices, future price increases, and the probability of retention.

Lifetime value or LTV is a measure used by other large publishers around the world, most notably the Financial Times, which for years has been a pioneer in building a digital subscriptions business. The FT is thus likely to have far bigger teams and more sophisticated analytics through which it makes its calculations

In a March 2021 INMA Webinar, Lucy Butler, chief analytics officer at the Financial Times, explained that the publisher has moved from focusing on web traffic, to a blended metric known as RFV (recency, frequency, volume). This was a leading indicator of acquisition and retention, looking at engagement, cancellation, and conversion rates, as well as revenue versus usage. Now the FT looks at quality visits and engagement to the current North Star metric of lifetime value (LTV), of which RFV is an important predictor.

Similarly, In August 2020, Dan Silver, director of newsroom innovation at The Telegraph in London, told an INMA conference how the publication moved away from a focus on subscriber acquisition-related numbers to a system called STARS — the Single Telegraph Acquisition and Retention Score. STARS, Silver explained, is actually a supermetric derived from three feeder metrics that identify and reward content that:

l Converts new subscribers

l Helps keep them subscribed

l Resonates with registrants and new users —

the potential subscribers of tomorrow Pre-STARS, Silver articles with high conversion rates dominated discussion and content strategies. “Now there is a new focus on content that encourages existing subscribers to return to our platforms or that drives high engagement with registrants and anonymous users.” Other publishers have attempted to arrive at similar measures for audience engagement by using sophisticated AI tools. The Norwegian publisher Amedia, which wanted to understand what kinds of user behaviour makes for a happily engaged customer on their platforms, handed over this decision to a machine learning algorithm, letting it select the best combination of metrics. The algorithm takes up to 70 reader behaviour statistics as an input and distils them into a single number that best predicts how likely a reader is to stay loyal to the product. At Amedia they call this number the “Engagemen Index.”

The situation is ever changing of course, but it’s worth pointing out that a recent Associated Press report brought attention to the fact that small newsrooms have fallen behind larger ones in adopting AI, and the technology is underused at the local level mainly because of time and resource constraints. Among the nearly 200 newsrooms surveyed were print, radio, television, and digital-only outlets.

EVOLVING STRATEGIES

- Take the wire

Did you ever think that using stories from the good old wire service might be a key factor in retaining subscribers? That sounds crazy when you’ve been investing in original reporting all this while, right? Well, a first-of-its-kind analysis using data from Northwestern University’s Medill Subscriber Engagement Index, published in March 2022, reveals that wire-service and syndicated content can help to develop reading habits and retain subscribers among light and very light readers. Even for the most ardent, heavier readers, wire content has a neutral – not negative – effect. “Syndicated content is important to grow engagement,” said Edward Malthouse, research director at Northwestern’s Medill Spiegel Research Centre and Erastus Otis Haven Professor of Integrated Marketing Communications. “Any story’s a good story if you can get me to read it.” Launched in October 2021, the Medill Subscriber Engagement Index is a tool that allows local news organisations to see what content encourages subscribers to stick around and lets publishers benchmark their performance against outlets in comparable markets. The project started with 44 newsrooms of various sizes across the U.S, while a further 100 outlets were expected to be on board by early 2022. The insight on wire stories was one of the first significant pieces of research to emerge from the project, and the analysis took into account tens of millions of page views by digital subscribers of two participating newspapers over 23 months, from Jan. 1, 2020, to Nov. 30, 2021. At first glance, Malthouse writes that the data appeared to show that wire-service content was not associated with retention or regularity, or had negative associations. The initial findings

aligned with conventional wisdom that readers put a greater value on original news accounts than on widely available, commoditised stories. A more detailed look however, showed the surprising benefit of wire-service stories for retaining digital readers who rarely use their subscriptions. News organisations need to reach these under-engaged subscribers before they cancel, and wire content can help, Malthouse aid. “It’s magic for light readers.” The latest findings were “obviously music to our ears,” Jim Kennedy, senior vice president of strategy and enterprise development at the As- sociated Press was quoted as saying in the article put out by Medill’s Local News Initiative. “We’ve always felt the local news readers are concerned about the whole range of news … world, national, business, sports, entertainment. You’re forcing them to look elsewhere if you don’t run any of it.” However, the piece notes there is an art (and science) to learning which wire stories can keep users engaged: “News organisations should blend sound editorial judgement with automated recommendation systems that direct readers to stories fitting their personal interests. Media houses need to detect the passion points for that reader,” it says. - Going big on games

The potential for puzzles and games as habitbuilding tools was thrust firmly into the spotlight earlier this year when The New York Times acquired the viral word game Wordle.

Even before that though, there had already been much talk and experimentation about games for audience and retention. In a way this should make perfect sense. As the digital analytics and AI company Twipe notes, puzzles and crosswords were the original gamification and habitforming tools for newspapers. That their draw has travelled over to the digital world is no surprise. One depressing statistic here. Twipe writes that the provision of puzzles is particularly important for publishers in the USA as just 55% are interested in the news, according to the Reuters Institute Digital News Report 2021. Aside from NYT and Wordle there are several other notable examples of publishers leaning heavily on games. The Wall Street Journal, for instance, discovered that puzzles played a major role in reducing churn. They therefore decided to add Puzzles as part of their onboarding experience, to encourage subscribers to get into the habit of playing daily puzzles. At The Telegraph in the UK, Twipe reported that puzzles play a vital role in habit formation for their subscriber-first strategy. Not only do their newspaper crosswords have a loyal following, but they drive retention habits with the answers posted in the following day’s edition. Telegraph subscribers are also now able to play their daily puzzles directly inside their digital edition app. The Atlantic is taking a slightly different approach, launching a new newsletter in December last year that seeks to bridge the gap between puzzle player and subscriber. The GoodWord newsletter is written by crosswordpuzzles editor Caleb Madison, and it actually serves as a useful entry point into The Atlantic. A piece in What’s New in Publishing noted this strategy worked well because as well as the written essay from Madison, each issue features that week’s top stories and Atlantic events. “Puzzlers who may have started with an interest in the crossword and how it’s built are now exposed on a weekly basis to The Atlantic’s full journalism. Their bet is that regular cruciverbalists with an interest in linguistics will also find commonality with the publisher’s more analytical, deep-dive approach to current events.”

IN CONCLUSION

The Covid years accelerated every trend that was already evident in the world. What it did for media in particular was move the needle, perhaps irreversibly, toward business models supported by subscriptions and reader revenue. As we write the conclusion to this chapter, news is still trickling through of major staff cuts and the possible closure of BuzzFeed News, one of the last pure digital players that tried to run a free for all news business model supported by advertising. In their place, as the Financial Times reported

at the start of the year, a new cohort of media startups are coming up which are focusing on paying readers and not just clicks.

“This generation of start-ups is distinct from page view-obsessed predecessors of the mid- 2010s, which gave readers stories for free in order to reach large audiences. Instead, these companies believe that journalism should be paid for and that, thanks to social media, individual writers can form relationships with their readers, in the same way social media influencers do with followers,” FT wrote, citing as prominent examples companies like Insider, Axios, The Athletic and the much awaited new global news operation (latterly, we learnt that is going to be called Semafor) that is being started by ex-Bloomberg CEO Justin Smith and ex-New York Times media columnist Ben Smith who

was also once editor of BuzzFeed. But, the FT article closes, it is too early to say how much space there is for all these subscriptions in consumers’ budgets. While the last two

years have brought significant upheaval, innovation and transformation, perhaps that is the one sobering thought that publishers must keep in mind as they navigate the times that lie ahead.

The first gold rush is likely coming to an end, and consolidation, rather than expansion, will be the name of the game. Therefore, think carefully about all the strategies laid out here for retaining subscribers, think about the investments you can make and remember: keep your heavy readers close, and your light readers closer!

The Innovation in News Media World Report is published every year by INNOVATION Media Consulting, in association with FIPP. The report is co-edited by INNOVATION Presidente, Juan Señor, and senior consultants Jayant Sriram and Inês Bravo