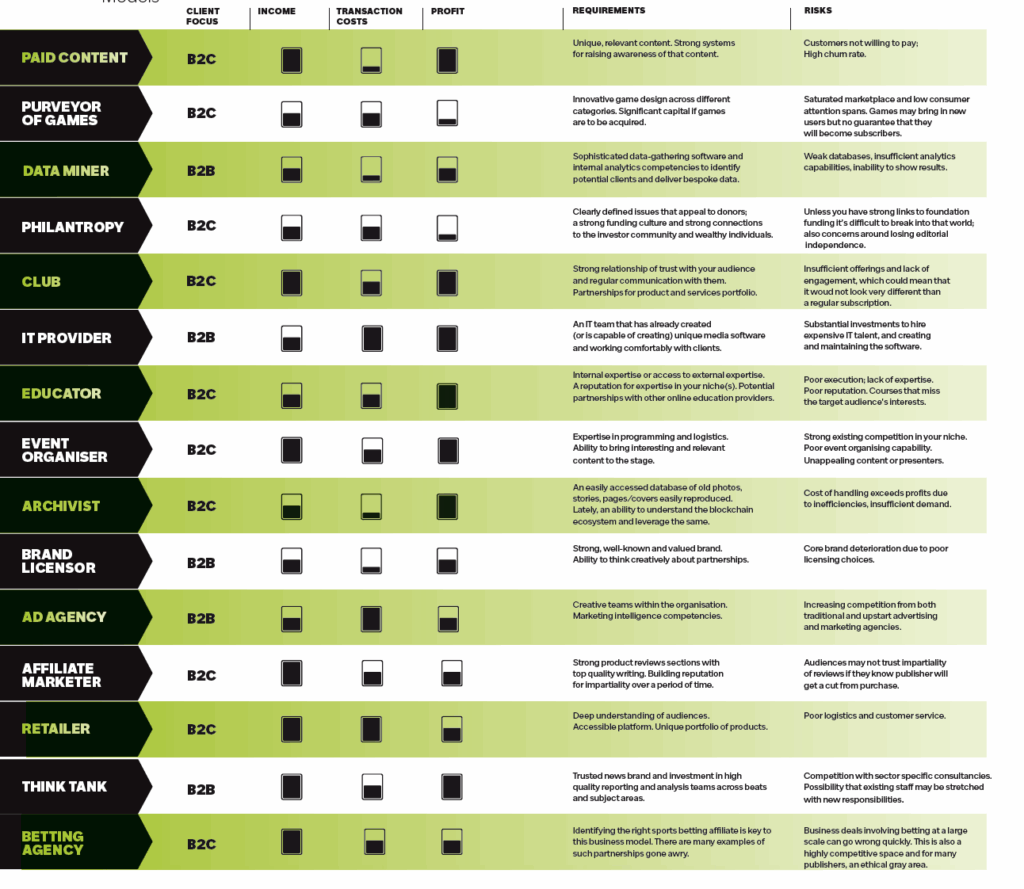

06 Oct Business Models

A substantial percentage of income from readers paying for content is still the business model that publishers should aspire to and is the best choice to anchor a sustainable digital publishing business model. Having said that, the next couple of years is probably the most important period ever in determining the future strategy around this model and the flexibility/adaptability that publishers will have to put on show.

Let’s do a quick rewind to unpack that thought. In the years before COVID-19, subscription revenue was making steady headway, though success skewed a little toward established publishers like The New York Times and Financial Times. The pandemic years however, sparked a frantic period in which it initially seemed like reader

revenue might become the only game in town worth focusing on. As interest in news spiked and people had more time on their hands while working from home, they took out multiple subscriptions to news organisations.

Two years on from that golden moment for subscriptions, several challenges lie ahead. As the cost-of-living crisis in many countries around the world shows no signs of easing, it’s inevitable that consumers will start to consider which subscriptions they really need. The Reuters Institute Digital News Report for 2022 noted: “in the face of rapidly rising household bills, we find some respondents rethink the number of media subscriptions they can afford this year – which include news, television, music, and books.”

Statistics at the end of 2021 from Toolkits and National Research Group showed that almost 30% of consumers polled plan to reduce the number of online subscriptions they hold. Toolkits’ Jack Marshall acknowledged the likelihood of a downturn, especially in the face of the “belt-tightening” economic conditions inevitably bring. But he said this wasn’t a sign of any fundamental problem with the subscription model.

“More than anything, publishers just need to be honest with themselves about whether they really have the content and products to support subscription models sustainably in the long term,” he said on the Media Voices podcast. The International News Media Association’s (INMA) Subscription Benchmarking Service reported a steady spike in subscription cancellations, though it expects digital subscriptions to grow overall in 2023, albeit more slowly. “If you compare the share of consumers having a subscription on a print newspaper 20 years ago with the share having a digital subscription now, the difference is 70%,” said Greg Piechota, researcherin- residence at INMA, at an industry conference in early 2023, explaining that the industry is still probably far away from their digital subscriptions peak.

Strong growth for trusted brands

The 2022 Media Moments Report, researched and written by Media Voices, notes that a select few have reported record performances, with quality content and trusted brands the designated driver. Having reached more than 9 million subscribers, The New York Times president and CEO Meredith Kopit Levien said its success was down to publishing the best content possible.

The Economist posted its most profitable year since 2016 on the back of 1.2 million subscribers and total subscription revenues accounting for more than 60% of its revenues. Referencing Russia’s invasion of Ukraine and inflation at its highest rate for a generation, editor-in-chief Zanny Minton Beddoes described The Economist’s content as delivering

“timely, mind-stretching analysis to subscribers, helping them to make sense of the world”.

The Times signed up an average of 1,000 new digital subscribers every day over the first two weeks of Russia’s attack. Times head of digital Edward Roussel told Press Gazette: “The trend that we’re seeing is that in moments of crisis, whether it’s the onset of coronavirus or Brexit, you see this shift towards trusted brands.”

A need for creative approaches

Hard-paywalling content, however, may not be the answer to everything for most publishers in an uncertain economic environment and a variety of softer and more creative approaches can be deployed. Reframing reader payments as memberships is one route that we will discuss later in this chapter, as is a more pragmatic approach toward advertising revenue mixing well with a subscriptions-first strategy.

“Seeing that subscription revenues alone might not be enough, one time ‘all-ads-are-bad’ content providers, from Netflix to The Athletic, are introducing advertising to bolster

their earnings,” the Media Moments report notes. “There is even a growing consensus that, post cookies, subscription publishers will be in a better position to offer advertisers

premium spots using the first-party data gathered from subscribers and registered users.”

KEY EXAMPLES

Bundle subscriptions

The Washington Post

The Washington Post began offering a subscription bundle earlier this year with the meditation app Headspace. Michael Ribero, chief subscriptions officer at The Washington Post, told Digiday that it was an effort by the publisher to market its recently expanded wellness coverage to those who aren’t frequent Post readers, and to increase its subscriber base by targeting those interested in verticals beyond its core politics and news stories.

The Post is “thinking about different onramps. For so long, we’ve essentially had one on-ramp – one price, one dimension of coverage being politics or opinion”, Ribero said. “We want to have more of these on-ramps for people to come on. We think non-hard news is a great one of those.”

The tactic is no doubt mirrored after the success other publishers — such as The New York Times — have had in growing their subscriber base by offering subscriptions to non-news content, said Arvid Tchivzhel, SVP of product at Mather Economics, a subscription management and customer data analytics firm that works with publishers. This comes as the Post is reportedly struggling to grow its subscription business — it has 3 million subscribers, the same number as in 2021.

“I’m sure [The Post has] done some forecasting around what that market [opportunity] is. But I expect certainly a bump in subscriptions for The Post based on that,” Tchivzhel said. Though the churn rate of a bundle subscriber will likely be “slightly higher” compared to a “native Post” subscriber, the offering will “still probably be a profitable outcome,” he added.

The Post’s strategy is to get a reader to subscribe through the bundle offering with Headspace and then pull that reader in to consume content from other non-hard news sections and come across the Post’s daily news coverage as well, Ribero said.

B2B Pro Subscriptions

Axios

Axios launched its subscription business, Axios Pro, in January 2022 and within that first calendar year, secured more than 3,000 paid subscribers who contributed about $2 million in revenue, according to the company.

According to Digiday, the price for an Axios Pro subscription, which allows readers to “go deeper” on topics ranging from media deals to health care policy, is not cheap. An annual subscription to one Pro newsletter runs $599 while an all-access subscription to every Pro product costs $2,499 per year.

The advantage of B2B and premium business subscriptions is that the retention rates tend to be higher on average, according to Justin Eisenband, managing director of the Telecom, Media & Technology industry group at FTI Consulting, when compared to news, politics or lifestyle subscriptions. However, “with corporate cut downs and expenses being looked at, there has been an uplift in churn there as well. [Business publications] are not immune to it”.

As a premium subscription model, subscribers are typically business professionals who are likely to expense the cost with their companies. Or in other cases, corporate subscriptions are sold to companies directly who have multiple employees reading the content at a lower rate per user. Because of this subscriber base, Axios runs the risk of its Pro product being ruled an extraneous expense and getting cut from the budget as a result of companies trying to stay afloat.

A number of publishers are now partnering with sports betting businesses. Although it’s a somewhat complicated area to enter into, given the ethical issues surrounding it, sports betting is being seen as a new opportunity to grow revenues as well as engage readers. That said, it can also be a tricky market to navigate. Let’s try to break this down:

Expanding Market

The sports-betting pie is increasing at an enormous rate. The American Gaming Association, for instance, reports that during August 2022, sports betting generated $471.4 million in revenues, a 116.2 percent increase from August 2021.

With online sports betting being legal in 33 US states, up from 18 in January 2022, many online news publishers are embracing potentially lucrative content partnership deals with sports betting companies. More than $80 billion was legally wagered on sports in 2022 and, according to Macquarie Research, the US sports betting industry is expected to produce $30 billion in revenue from an estimated $400 billion in wagers by 2030.

Part of this growth in sports betting is due to advances in technology, which is light years ahead of where it was just a few years ago, both in user-friendliness and access to accurate live data, writes Adam Fiske CEO and Co- Founder of Cipher Sports Technology Group, for State of Digital Publishing. This is largely thanks to AI-powered analytics and machine learning models, which allow sports betting companies — and affiliates alike — to generate highly accurate data and insights on betting outcomes. In countries like the UK, the numbers are much smaller than across the pond. Sports betting market value in the UK totalled $5.4 billion in 2021. Figures from that same year indicated that the nation held 23% of the sports betting market in Europe.

So how does this all mix with journalism and news? From a journalistic perspective, some sports betting reporting is undeniably a service to sports fans and readers. For publishers, sports betting offers another potential revenue stream, and the pie will only increase as more states legalise it, and more fans view it as integral to their love of sports.

“Many media companies have identified a new pivot: sports wagering,” says Will Yakowicz, Staff Writer, Forbes. “Since the US Supreme Court struck down a ban on sports betting in 2018, 26 states and Washington, DC have launched legal markets and the industry is on fire and flush with cash.”

Reporting on sports betting, several sports media publishers realised, was a natural extension of its overall coverage. As sports media and sports betting have become cosier, newspapers and news outlets are realising there are revenue opportunities for them, too — and they can’t overlook any new revenue streams as traditional subscriptions and advertising dollars shrink. Entering these partnerships is also a benefit for sportsbooks, as they have less costly access to customers than spending large ad budgets.

KEY EXAMPLES

Gannett

It’s no surprise then that many news publishers are beginning to recognise the affiliate marketing opportunities now available through online sports betting. In July 2021, Gannett, the largest mass media publisher in the United States, signed a five-year partnership with European sportsbook Tipico, in a deal worth $90 million, which was restructured a year later. By the terms of the deal, Gannett gained the ability to earn affiliate revenue on new betting customers that it sends to Tipico, as well as the opportunity to own up to 4.9% of Tipico stock based on a variety of performance goals. In return, Gannett will provide Tipico with access to its 250 local sports markets and its 50 million monthly visitors through branded columns, newsletters, blogs, and other sports media coverage.

“Our highly engaged audience of more than 46 million sports fans crave analysis, betting insights, odds and unique features which we will provide with our Tipico alliance,” Michael Reed, Gannett Chairman and Chief Executive Officer, said in a release. “Tipico adds incredible expertise from their European operations and next generation product capabilities, which offer our sports enthusiasts and local consumers a way to become even more invested in the games and sports they care about.”

The statement from the publisher went further in elaborating on how the partnership would be mutually beneficial. “Gannett is uniquely positioned to reach sports enthusiasts

through its footprint in over 250 communities across the US, and with more than 500 respected sports journalists covering both professional and college sports and writing for dedicated NFL, NBA, and college football fan sites. The Company also plans to invest in talent across product and editorial divisions to develop new, innovative experiences and content for its sports readers.”

Fox News

In November 2022, Fox won the right to buy an 18.6% stake in sports betting company FanDuel Group after an arbitrator’s ruling. The Wall Street Journal reported that the ruling paves the way for Fox Corp. to take a bigger position in the fast-growing sportsbetting industry.

FanDuel is the biggest brand in the market and Fox Bet, an earlier venture by the Fox Corporation, had struggled to gain a foothold in the states that it was operating.

Front Office Sports

PointsBet, an Australian online sportsbook operator, has partnered with publisher Front Office Sports to launch a sports betting newsletter. The company launched in New Jersey, US in 2019 and has since expanded to 14 states. The objective behind the media partnership is to grow its presence in the US, reports Sara Fischer for Axios. “Sportsbooks are looking for cheaper and more sustainable alternatives to accrue customers and engage them rather than spending millions of dollars on paid digital marketing,” she adds.

The newsletter will be created by Front Office Sports under the guidance of Teddy Greenstein, Senior Editor, PointsBet. It will be initially sent three times a week to PointsBet’s

approximately one million free email subscribers. The company plans to later increase the frequency to five times a week.

The publisher has been generating revenue primarily by “selling sponsorships around its own content and newsletters, instead of licensing its tech to other companies.” It is

profitable and is expected to generate $8-$9 million in revenue this year, which is roughly double that of the previous year, CEO Adam White tells Axios.

Benjamin Black, Co-Head, Internet Equity Research, Deutsche Bank, believes this to be an attempt by some sports betting companies to penetrate the US market. “Valuations

for sportsbooks that have exposure to the US market are insane right now— they’re up and to the right,” he says. “This is gold rush.”

AP

AP, which partnered with sports betting company FanDuel in 2021, chose its sports betting strategy after learning that its readers wanted more bettingrelated

content. “We have heard from dozens of customers over the last six months asking for more sports gambling stories on the wire and gambling info in our fixtures,” reads an internal memo shared by Forbes. “We know that a huge increase in interest in sports over the past two years has been due to the expansion of legal sports gambling, which

will soon be available in more than half of the country. We’ll look for more smart ways to serve that readership.”

Other publishers interested in adding sports betting content to their offerings or partnering with such a business may benefit from following AP’s strategy. If the readers want it and the publisher can offer it (for example, if it already specialises in sports content) then it might be worth going ahead with.

Sports Illustrated

SI and 888, a Gibraltar-based sports betting outfit, collaborated to launch SI Sportsbook in Colorado in 2021. 888’s objective is the same as PointsBet – to grow its business in the US. ABG on its part is looking at the partnership to “generate new revenue and relevance for the legacy brand,” writes Ashley Rodriguez, Media Editor, Business Insider. The company is “marshalling other extensions of SI, including the editorial arm operated by the Maven Group, to promote the sportsbook.” Indeed, as Yaniv Sherman, SVP and Head of US, 888 says, “[t]he trick here is not to lose your core legacy consumers which consume editorial and creative content, but to add new things.”

The Washington Post

The Washington Post has launched its Odds Against sports betting series with comprehensive reporting, predictive analysis, and advice, but currently has no plans to partner with a sportsbook. “We launched Odds Against first and foremost because we believed in its journalistic value, but we are also viewing it as an experiment to gauge reader interest in enterprise and advice coverage of sports gambling — both among our existing subscriber base and among new readers,” Jeff Dooley, special section editor, says.

“We wanted to dedicate coverage to the impact that legalised betting was having on the sports world — including explanatory and accountability reporting in areas like sports broadcasting, gambling addiction and sportsbooks’ acquisition strategies — while also providing measured, independent advice for the growing segment of Americans who bet on sports as a hobby,” Dooley adds.

Neil Greenberg, who has been covering sports for The Post since 2010 as a freelancer and now as a sports reporter, will be the primary lead for Odds Against. “Odds Against allows us to explore fully the educational side of sports betting. Anyone can give picks and potential wagers, but we strive to educate readers and explain the nuances of each betting market,” Greenberg said.

The Timwa-PiXyunw | The New Orleans Advocate

When sports betting became legal in Louisiana in June 2021, retail wagering in October 2021, and then online in January 2022, The Times-Picayune | The New Orleans Advocate, wasted no time assembling a team to create a sports betting platform. Judi Terzotis, publisher, and the workin group created a business plan with the express purpose of sports betting becoming a new revenue stream. To launch NOLA.com’s sports betting platform, The Advocate proactively invested in several new hires — reporting team to write sports content exclusively based on sports betting Another person was added to the analytic department, and the marketing and digital teams were expanded.

A critical element of the plan was establishing a partnership with a sportsbook so readers could click through to its site to make bets directly from NOLA.com. Terzotis said, “We talked to several of the sportsbooks and had a nice connection with Caesars. It just felt like a very good partnership. Caesars has the naming rights to the Superdome, so they have a relationship with the Saints, and we have a partnership with the Saints. They also struck a deal with the Louisiana State University Athletics department, and we are the sponsor of LSU Athletics.”

The Advocate didn’t require an affiliate licence to partner with Caesars and add the link. The sports betting articles have also quickly become some of the top-performing weekly content, which drives subscriptions and online traffic. According to Terzotis, a publisher needs a very large and engaged sports audience to partner with a sportsbook.

From that solid base of sports reporting, sports betting content can be added, attracting the betting audience.

As The Advocate’s sports betting initiative has become widely known, many newsgroups and publishers, especially smaller companies, contacted The Advocate to learn how it had launched the NOLA.com sports betting section, partnered with Caesars and generated revenues. That was the motivation to create a new division of Georges Media Group, the parent company of The Advocate and other publications.

Boston Globe Media

In 2022, BGM announced it would be launching a sports betting section on its site Boston.com in partnership with Better Collective, a global sports betting media group. A memo shared by the publisher’s Chief Commercial Officer, Kayvan Salmanpour and GM, Matt Karolian, reads: “The section will provide our readers with content, data, and statistics for sports coverage and sports betting.”

“This partnership will also allow us to monetise the section through sponsorship and a revenue share with Better Collective. This is the largest deal for Boston.com in recent history, and a reflection of the investment we have made in rebuilding and modernising the entire site, better connecting it to our community.”

Better Collective already had successful partnerships with the Chicago Tribune, Philadelphia Inquirer, and NY Post. For BGM, this partnership would allow for additional deals

with sports betting operators to drive incremental revenue. It was also meant to contribute to the publisher’s continued effort to diversify revenue for the site beyond advertising.

However, in May 2023, Better Collective sued Boston Globe Media Partners over an alleged breach of contract. The lawsuit claimed that though both parties agreed to negotiate a reduction of any fee owed to Globe Media by BC in the case of regulatory changes from the Massachusetts Gaming Commission (MGC), the BGM did not follow through on its promise.

According to the lawsuit, BGM raised “false allegations of impropriety on the part of BC in a transparent and improper effort to leverage a resolution to avoid the consequences of its numerous breaches of the Agreement and mandatory reduction in fees.” BGMP intends to file counterclaims.

Home Field Sorts

Home Field Sports creates and offers other publishers a complete package of content, live shows, and access to a sportsbook. As of mid-November 2022, it had more than 1.2 million page views, almost 12,000 subscribers to its sports betting newsletter, and more than 6.6 million views of its sports betting shows. The team provides strategic and creative support, reporting, and analytics, and can customise a sports betting platform based on what a news outlet needs and the sports betting regulations of the state it is located in.

“The interest and participation in sports betting aren’t limited to large markets with large publications like The Advocate,” said Young. “We wanted to assist smaller publishers and news outlets that didn’t have the financial and reporting resources to start a sports betting platform so they could benefit from the potential revenues.”

The weekly content for all Home Field Sports partners’ sites includes sports betting stories of national interest, such as National Football League (NFL) picks and best bets. A feature article customised for each partner’s geographic area is carried, as is a weekly customised newsletter for readers in those areas.

“When a news outlet expresses interest in becoming a Home Field Sports partner, our first step is plenty of research, including Google trends, to reveal which teams in the area are of the greatest interest,” says Zach Ewing, the sports betting editor. The team talks with the sports editor of the news outlet and any local sports experts; this helps them make decisions regarding where to focus editorial and marketing resources.

Home Field Sports content seeks to educate people on sports betting and provide them with the information to become more engaged with the content, which explains the betting process, terms and odds. It also promotes responsible wagering and provides a phone number to a gambling problem helpline. Partners can also choose to include the Sports Betting 101 guide on their site.

“My advice to any news outlet is first to serve the readers with custom content about the area’s teams and then include the sports betting angle because many fans who may not ever bet are still interested in the line for a particular game. Serving the reader first grows the audience, and a bigger audience will attract more advertisers,” Ewing says.

Major growth

industry in the next 10 years “Broadcasters and publishers started taking ad dollars from gambling operators and dabbling in betting content a few years ago,” explains Business Ashley Rodriguez, “as the US regulatory tide turned in favour of the industry that had long been viewed as a vice. The ties between media outlets and gambling operators have deepened since.”

These deals between media and “ gambling companies are mutually beneficial, according to Chad Beynon, an analyst at Macquarie. They offer exposure to a fast-growing industry as well as an opportunity to grow revenue. “This is certainly a new avenue, a new stream for them to capitalise on in what will be a major growth industry for the next 10 years,” says Benyon. “And I think they’re very well positioned to be a part of the ecosystem.”

Third party vendors

A number of third-party vendors are also entering the fray and offering bespoke sports betting solutions for publishers. Indeed, whilst the rapidly growing interest in sports betting is a strong opportunity for publishers, it is often outside of their core content wheelhouse. Spinning up new site sections places additional demands on already-taxed content, product, and development teams. STN Video, as one example, has launched a white-label sports betting solution designed as a plug-and-play solution.

Assessing Potential Partners

When partnering with a sports betting affiliate, Cipher’s Adam Fiske has some advice for publishers. They will want to enter a mutually beneficial relationship between themselves and their partner. In a typical affiliate deal, Fiske writes for State of Digital Publishing, the affiliate’s role will be to provide betting predictions and contextually relevant content on upcoming games, which the publisher will then share with its audience via its digital platforms. Each time a new customer is referred to a sportsbook from this content, the publisher is paid a referral fee.

But with so many affiliates to choose from, it’s vital to evaluate each potential partner before signing on the dotted line. With that in mind, he outlines four things an online news outlet should consider when evaluating a potential partner.

- COMMISSION STRUCTURE

In the US betting market, most partnership deals between publishers and sports betting affiliates are based on the cost per acquisition (CPA) model. This calls for a fixed

commission price paid by betting operators for each person who clicks through and places a bet. On the face of it, this CPA model can seem like a great deal for both parties,

but it’s not necessarily a licence to print money when dealing with audiences that don’t typically have a high propensity for betting.

For instance, a person may be willing to take advantage of special offers that provide a free first-time bonus bet for new users, but they may be unwilling to place further bets in the future once their initial $10 or $20 deposit has been wagered, which is often needed to trigger the bonus in the first place.

This is something the sportsbooks monitor very closely. For this reason, it’s likely that sportsbooks will start to shift their marketing focus over time. Their goal will change from getting the most users possible to securing the most out of each individual user through retention strategies such as rewards systems, in-app messages and loyalty offers.

As such, a better partnership deal might be a revenue-sharing model that is conditional on the value that each user brings to the betting operator. Such a system could be highly beneficial for both parties as it would incentivise the publisher to pass more valuable users through to their sportsbook partners. - REPUTATION

The market for online sports betting is ballooning at an enormous rate, and not every sports betting affiliate will be fully suited to your digital publication. Make sure you

do your research on each individual company and find out what their other partners are saying about them, Fiske says. If you don’t, you could end up in a partnership that doesn’t deliver the type of results you expect. - ASK FOR PROOF

OF SUCCESS

The easiest way to gauge the expertise of a betting operator is to ask for proof of success through things such as case studies and testimonials. Most businesses will understand the value of such social proofs and will be happy to provide anything they have. Another good proof point for choosing an affiliate partner is how good their

technology is, how easy or difficult it might be to implement on your platform, and how much work will be required at your end to ensure some worthwhile reward for effort.

Serious bettors will take time to compare various offerings and see which one provides the best combination of trustworthy content and strong user experience. A publisher

should do the same when considering an affiliate partner. - DUE DILIGENCE

Before signing anything, take plenty of time to read and understand the terms and conditions of an affiliate partnership programme.

The “cookiepoalypse” has been coming for some years now, though there seems to be a reluctance on all sides to finally pull the plug. The date now given by Google for the phase out of third-party cookies on its Chrome browser (which accounts for over 65% of the global desktop browser market share) is by end 2024, a deferral first from end 2022 and then end 2023. In the interim, the tech giant says it’s been working on an alternative that’s less invasive to privacy but it is a little hard to tell now what the status of the much-touted Privacy Sandbox project is. Will it be a viable alternative? More importantly, should you be relying on Google or planning ahead?

Letting go of an old business model, one that has underpinned much of digital publishing as we know it, is hard. The demise of third-party cookies is a big win for online privacy but is a difficult proposition for the publishing industry. Because they track user history and serve up relevant ads, third-party cookies form the backbone of programmatic advertising. A survey by the INMA in 2020, when news first broke of the cookie phase-out by Chrome, revealed that 85% of news executives said their online ad revenues depend on third-party cookies. What is beyond dispute now, however, is that this has not been a positive thing at all for publishers. We’ll make this point through the words of Simon Owens, and his excellent Substack newsletter on the media industry. In a recent edition, he identified the open embrace of programmatic advertising as the “original sin” of media companies in the digital age.

Owens argues that programmatic adtech wrought harm on the industry in four major ways.

1) It fueled ad fraud

2) It funnelled ad budgets to lowquality publishers

3) It devalued news

4) It prioritised display advertising We’ll expand a little on that last one. Owens points out that display ads provide very little value to marketers. News consumers don’t look at or

click on display ads, and a sizable portion of the population installs ad blockers to avoid them. “And yet, for reasons I can’t fathom, most of the programmatic adtech industry

We’ll expand a little on that last one. Owens points out that display ads provide very little value to marketers. News consumers don’t look at or click on display ads, and a sizable portion of the population installs ad blockers to avoid them. “And yet, for reasons I can’t fathom, most of the programmatic adtech industry has oriented itself around display advertising,” he writes.

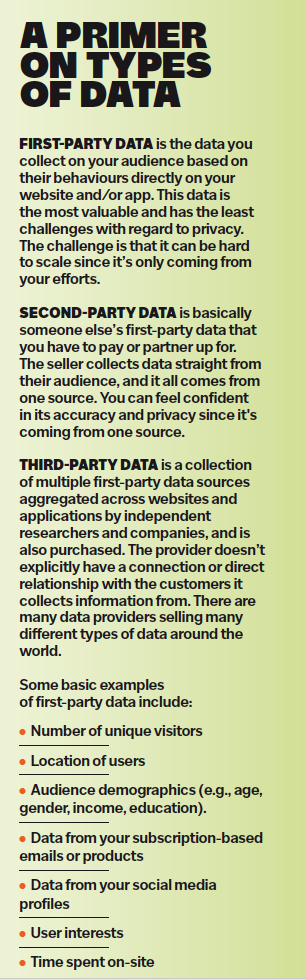

So what is the way out of this messy ecosystem? The key is in prioritising the collection of first-party data. Publishers have a direct relationship with their audiences and can collect information directly from their readers, listeners and viewers. This is invaluable information that can be used internally to build better products and plan revenue strategies, but also offered to advertisers. Both media companies and brands want to target and build relationships with actual people. What third-party data held by others offered instead was aggregations layered upon each other to create customer attributes rather than people. There may be a loss of scale initially, but scale never brought in the ad dollars it promised anyway.

Even as the tech industry debates what kind of system might follow third-party cookies, we find that a number of publishers have been thinking proactively about how they might approach the collection of data for the future. Many of these successful experiments have run for a few years now so there’s a lot to track, learn, and try to implement at your own publication.

EXAMPLES

Vox Media – Forte

Vox announced the launch of its first-party data platform at the end of 2019. Digiday reported that even with the shock of the pandemic that struck a few months following Vox’s launch, Forte wound up having a very good year. More than 100 brands tried using the platform and by the end of 2020, Forte data was used to drive “nearly half” of Vox Media’s display ad revenue, chief revenue officer Ryan Pauley told the publication. That share grew to about 66% in 2021 and is expected to grow further. Vox is still trying to figure out the way in which clients can use it and how widely it wants to make Forte segments available outside of its own ecosystem.

The bulk of the data Forte uses to infer audience interests and intent comes from the content Vox Media’s audience consumes across both Vox Media and New York Media, which Vox acquired in 2019. But it draws from other sources too, including offline data about people who have attended in-person events, such as Eater’s dinner series Young Guns, as well as subscriber data gathered from New York Media and commerce data gathered from New York Media’s commerce brand, The Strategist.

The New York Times

The New York Times announced in 2020 that it would stop using third-party data to target ads in 2021 and work on creating a proprietary first-party data platform. Axios reported that year that the publisher would start offering companies proprietary first-party audience segments to target ads which would be broken into five broad categories: age, income, business, demographic, and interest. “This can only work because we have six million subscribers and millions more registered users that we can identify and because we have a breadth of content,” Allison Murphy, Senior Vice President of Ad Innovation, told Axios.

News Corp

A few years ago, News Corp launched News IQ, a new advertising platform in the United States. “This marks the first time that News Corp has integrated all of its collective first-party data, premium media properties and data science tools into one unified advertising solution. News IQ will give brands a new way of reaching News Corp’s sophisticated audiences in a safe, trusted environment to achieve precise and measurable results,” a release from the company said.

Insider – Saga

Insider launched its first-party data platform in early 2020 and spent much of that year getting advertisers comfortable with their product. In 2021, over 140 advertisers ran ad campaigns on Insider using Saga data, up from 48 the previous year, the publisher told Digiday. While many of those were first-time customers, a significant percentage were not. What’s more, the advertisers that bought ads from Insider using Saga had a renewal rate of 48%, and the amount of money those advertisers spent on average tripled, according to a company spokesperson. On the whole, the amount of revenue Insider generated on campaigns using Saga rose 175%, from a not-insignificant base. “We went from millions to tens of millions [in revenue],” said Jana Meron, Insider’s SVP of programmatic and data strategy.

Above and beyond these very impressive numbers, Meron said that Saga is now being used by different parts of the Insider’s organisation for a number of different initiatives, including audience extension projects designed to drive subscription growth.

South China Morning Post – LIightHouse

The Hong-Kong-based publisher launched its first-party data platform Lighthouse in 2019 to better understand its users and provide advertisers with the tools necessary to target audiences with greater precision. Speaking at an INMA conference in July 2021, Ian Hocking, the then vice president of digital at South China Morning Post in Hong Kong, shared the amazing range and types of data that Lighthouse could offer as audience segments. These were:

l Preference: A long-term attribute unlikely to change.

l Opinion: Current way of thinking, which might change based on circumstances.

l Sentiment: The positive, neutral, or negative feeling about an article.

l Intent: Declared action to do something.

l Behavioural: A predictable, usual way of being.

l Interest: Declared passion for something.

Washington Post

-Zeus Insights

The Washington Post developed a first-party data ad targeting tool called Zeus Insights in 2019, which is licensed out to publishers and allows them to utilise first-party reader data to sell highly-targeted adverts. The platform monitors contextual data such as what article a person is reading or watching, what position they have scrolled to on a page, what URL they have used to arrive there and what they’re clicking on. It currently has over 200 publishers who are at various stages of using the Zeus platform.

CHALLENGUES

Words of caution once again from the Words of caution once again from the Reuters Institute Digital News Report, which finds that most consumers are still reluctant to register their email address with news sites. “Across our entire sample, only around a third (32%) say they trust news websites to use their personal data responsibly – comparable to online retailers such as Amazon – and the figure is even lower in the United States (18%) and France (19%),” the report notes. Publishers have to work out ways of getting audiences to part with data while still keeping it a careful and considered process.

Memberships have been touted in many conversations recently as the future of reader revenue and we tend to agree. The overall numbers for digital subscription growth, when surveying publishers across the world, seem to be holding steady, but subscription fatigue is a real thing. As is the point, often stressed by the Reuters Institute Digital News Report, that subscription plays tend to favour the bigger players on the market. Combine all that with concerns about cost of living and you can see why there is an imperative to reframe the idea of reader payments. Paywalls can be “blunt force instruments” that may not work for all publishers, FTI Consulting’s Justin Eisenband told Digiday in an interview last year. It’s still one of our favourite quotes that best describes the issue.

What does it take then, to shift toward a membership economy? Let’s start with defining memberships first, and we can rely here on an excellent resource: The Membership Guide published by The Membership Puzzle Project (MPP), a public research venture that analysed membership models worldwide.

As the MPP notes, membership is not the only audience revenue and engagement model available to news organisations. But they can be extremely effective when deployed

with the proposition framed correctly and key audiences identified. Over the years membership models in news have included features such as access to member-only content, fewer ads— or an ad-free experience—as well as early-bird tickets for public events, partner products and other perks, and members-only events. However, many modern membership models increasingly have an element of reader participation in the vision and mission of the organisation and creative ways of bringing the reader to interact with the newsroom.

KEY EXAMPLES

Tortoise Media UK

Launched in April 2019, the “slow news” digital outlet Tortoise now has over a 100,000 members. About half of the members pay for their own membership, while the other half are funded by Tortoise’s corporate partners through a bursary scheme called Tortoise Network. The sponsored membership programme allows the publisher, in collaboration with charities, to bring in people who otherwise would be excluded.

Liz Moseley, CMO and Partner at Tortoise Media told WAN-IFRA this is a very deliberate strategy designed to ensure a diversity of voices: “It gives us a much greater richness to the possibilities of stories that we can cover in an authentic way.”

A keystone of Tortoise’s audience engagement strategy are the ThinkIn events, which Moseley described as building on the idea of the editorial conference. But instead of the newsroom discussing its editorial point of view and news agenda internally, members and outside speakers are also included in these conversations.

The concept is relatively simple: each ThinkIn tackles a specific question, with participating members and expert speakers voicing their views in a “forum for civilised disagreement.” The goal is to formulate an editorial point of view by the end of the event. “We don’t always produce a leader column, but we ought to be in a position to do that

by the end,” Moseley said.

Moseley underlined the importance of these events in building strong relationships with the audience. ThinkIns started as live events, allowing members to physically join the team in the newsroom, and about half of members participated in them. Since ThinkIns moved online because of the pandemic, about 70% of members have been to at least one.

Tortoise has also observed that participating in ThinkIns boosts reader retention, Moseley said: “We know that once you’ve been to a ThinkIn, your propensity to renew your membership is dramatically increased.”

Gazeta Polish publisher Gazeta Wyborcza has a premium package that allows readers access to a range of digital content, but it was the launch of Wyborrcza.pl Club that has played a transformative role in the growth of its subscriber base to about 280,000. Membership to the Club allows direct contact with the newspaper’s editorial team including participation in online meetings.

“We know that for many of our subscribers Wyborcza is something more than just published articles. It is a strong bond and a sense of belonging to a community of like-minded people who believe in democracy, human rights, tolerance and the European Union. But also those who are curious about the world, rather kind optimists, who love good books and movies and their little homelands.

These readers discuss on our forum, write letters to us, come to meetings. And our Club is for them,” Bartosz Wieliński, deputy editor-in-chief of Gazeta Wyborcza, told What’s New in Publishing.

The results have surpassed expectations, with live meetings attracting anywhere between 300-1,500 people, with many more watching retrospectively ‘on demand’.

The Guardian UK

The pioneer of the support mission approach to memberships and a model that inspires publishers around the world, The Guardian announced in December 2021 that it had reached more than 1 million recurring digital supporters.

Digiday reported that the company has grown revenue from digital subscribers and contributors by 87% in three years. In summer of 2021, the Guardian announced digital reader revenue grew to £68.7 million (roughly $88.2 million) — a 61% increase year over year. Katharine Viner, The Guardian’s editor-in-chief, says it took six years from when they first asked readers to contribute financially to support The Guardian’s journalism. The strategy has been brilliantly successful and shows a deep connection they have

with readers; so many have chosen to support the publication without the imposition of a paywall. Although the outlet has begun to show readers a registration wall, they can decide to register later and finish reading the story with a click of a button.

Quarzt US

Here’s an interesting case study, detailed in the 2022 Media Moments Report. Just as every other publisher was trying to figure out how to gate their content, Quartz tore down its paywall last year. The plan shifted from a fairly strict content lockdown to the bulk of the business site’s content being available at no cost.

You could be forgiven for thinking that the pivot was an admission that Quartz’s beleaguered membership offering had failed. The four-year old programme attracted just 10,000 subscribers in its first year and even after a post-management buyout plea in 2021 spiked sign-ups, it was still under 30,000.

Low numbers are undoubtedly a factor in the shift – no one ever tries to fix a media model that isn’t broken. But there was also another, more interesting rationale at play. CEO Zach Seward explained: “We found that 75% of Quartz members read us primarily through email, so we’ve been putting more of our best stuff directly in their inboxes.”

The new email-first membership scheme will see paying customers get four ‘premium’ emails a week. Seward said the problem the publisher had been facing was converting drive-by site visitors into subscribers. “The part that hasn’t worked well is when a reader coming from Google hits our paywall, wants to read the article, but has no intent to remain a member. That has not produced enough value for Quartz or our readers to justify the downsides of the paywall in terms of reaching more people with our great journalism.”

Contrast that with the success Quartz has seen in converting loyal email readers to paying members and the move might just make sense.

Be Inspired

Aside from a comprehensive breakdown of how memberships models work for publishers and a technical breakdown of how memberships differ from subscriptions

and the donation model, the MPP’s Membership handbook also has a range of inspiring case studies from around the world. Go study it in detail!

When they develop particularly successful in-house tools, media companies can consider IT licensing services to their peers in the industry, as well as looking to grow beyond. This is a particularly good way of increasing the brand’s prestige as an innovator looking to find solutions to the various publishing and communication challenges.

The only note of caution we would put out with this model are news reports from 2022, including from The Wall Street Journal, that The Washington Post is looking to spin off or sell its software business, dubbed Arc XP, since it is not yet profitable. If that happens, it would be a blow for this particular business model for which The Post has been the chief flagbearer since Jeff Bezos took over. Nevertheless we are watching this business model keenly for more updates.

EXAMPLES

Washington Post – ARC XP

Despite talk of a sale of the software business still cropping up now and again, Axios reported last year that The Washington Post is looking to double down on its investment in

Arc XP, despite outside sales interest valuing the company in the low nine figures.

Arc XP is a cloud-based digital platform that helps a range of companies publish and make money from their content online. Though it operates as an arm of The Post, it is conveniently hosted on Amazon’s own cloud computing services. A 2021 post from the publisher noted that Arc XP had grown rapidly, establishing itself as an industry-leading, cloudbased digital experience platform. “The platform now powers more than 1,900 sites around the world, reaching over 1.5 billion unique users each month,” The Post noted.

“I personally think that in the long run — and by long run, I mean, three, four years, not 15 years — Arc XP will be the biggest source of revenue for the Post, and certainly the most profitable source of revenue for the Post,” Shailesh Prakash, chief information officer at The Post at the time, told Axios. Reportedly, Arc XP brings in roughly $40-$50 million in annual recurring revenue.

Coupled with its affiliated ad buying and ad rendering platform, Zeus Technology, Arc addresses the entire range of technology needs for digital publishers, from production

to monetisation. The Post has been licensing its technology to other news organisations since 2016.

Axios

In February 2021, Axios launched a software-as-a-service business called Axios HQ, which developed into a seven-figure software licensing business within a year, according to

Digiday. “Axios wants us to read everything in bullet points”, reads a catchy headline in The New York Times, profiling the company and its rapid growth. And indeed, that’s what Axios HQ does – it is designed to teach companies how to write with Axios’ trademarked editorial style of “Smart Brevity” for internal communications. After just eight months, according to Digiday, HQ has earned over $1 million in software licensing, which starts at $10,000 for an annual contract, and is projected to hit $1.5 million by the end of the

year. To date, as per the Digiday report of October 2021, 30 clients have paid for these services in addition to the software licensing, some paying upwards of six figures for an annual contract.

“I view this as, ‘Can we be a Bloomberg? Can we have a terminal business and a news business?’ In our case, we would have this communication business and a news

business,” Roy Schwartz, Axios’s cofounder and president, told Digiday.

Through Axios HQ, Axios provides licencees with email templates for different types of memos (currently there are six templates available); an AI editing programme, similar to

Grammarly, that provides suggestions for succinct and thoughtful phrasing; and analytics software that tells senders info about any given email sent through the platform, like open rates and engagement.

Currently, HQ has 450 clients, many of which fall in the expected category of small- to midsize companies, but also includes blue-chip companies, like Delta Airlines, local governments, and even educational institutions, like Austin Independent School District, which uses HQ to communicate with parents, students and staff.

The Glob and Mail, – Canada – Sophi

After almost eight years in development, Canada’s The Globe and Mail launched Sophi, its homegrown artificial intelligence startup in 2020. Three years and several awards later, Sophi is one of the most exciting software solutions for the news industry. The Globe and Mail has been using the software to place content as the AI has been trained to understand what belongs where on the website and updates pages with stories that warrant increased promotion. Sophi can also help automate print layouts.

Most impressive perhaps, is that Sophi runs a real-time, personalised paywall that considers the content a reader has consumed and understands when to ask a reader for money versus an email address — and for that matter, when to leave them alone and ask for nothing.

Globe and Mail’s chief executive, Phillip Crawley, told Press Gazette that Sophi drives much of the news publisher’s recent subscriber success — the paper now generates 70% of its revenues from subscriptions. Sophi has put itself in position to be adopted by several publishers. More than 50 titles spread across 11 different publishers have already adopted Sophi.

CHALLENGES

Sophisticated technology comes at a cost that many publishers may not be able to afford. Refer to the top of the chapter and the news that even gargantuan investment from Jeff Bezos may not be enough to make the Post’s tech publishing arm profitable. As The Wall Street Journal reported, “Lining up customers who are willing to pay six- and seven-figure sums for publishing technology may be a tall order in a digital media industry where many players are struggling to meet their financial targets.” Selling outside of media is an excellent option for the select few who can produce sophisticated tech.

When a publisher’s brand has high intangible value, it can be worth licensing the name to other related products or services to bring in income. This could take the form of the publisher lending its name to events or even entering the retail space by creating its own line of consumer products. This direct-to-consumer approach is growing ever more

important as media companies around the world move away from traditional forms of advertising. Leveraging insights from first-party data can be key to creating these partnerships.

KEY EXAMPLES

Forbes

Some interesting examples for the continued success of brand licensing were discussed at last year’s Future of News Media Technology conference organised by Press Gazette. Over the last 12 months, Alex Wood, Managing Director of Forbes Europe, revealed that its consumer revenue is up 40%, and a surprising proportion of this has come from merchandise.

People are willing to wear the Forbes brand. The example was given of colleagues buying Forbes baby clothes for his newborn child!

Footballco UK

Mundial football magazine spotted a niche for nostalgic football clothing and memorabilia. Juan Delgado, CEO of Footballco told attendees at the same conference how it tapped into this with its own internal shopping desk, with its highest selling item away from the magazine being Mundial socks. The publisher’s other title Goal has seen similar success with merchandise. Its Goal Studio store now generates gross revenue in the tens of millions. These products offer a low margin for media, but they’ve worked well.

Delgado’s biggest piece of advice for success in branded content? “It’s about how you create a brand which builds a cult around it. You can sell whatever you want as long as it’s authentic.”

Hearts

Hearst launched a line of Country Living Magazine-branded mattresses in late 2021, the first product in a multibrand licensing partnership between Hearst Magazines and Idle Group, which specialises in bedding and home furnishing categories. It was the first in the line of many more products that the publisher rolled out, tied to data insights from other brands like Women’s Health and Men’s Health. The key to this was information that the publisher collected directly from its audience. Digiday reported that Hearst’s first-party data showed that its readers are willing to pay for expensive items — and make these big purchases online. As of February 2022, Hearst Magazines’ print and digital assets reached nearly 165 million readers and site visitors each month. “Our affiliate channel data was helpful in selecting categories, as was just watching consumer behaviour on our websites,” Sheel Shah, SVP of consumer products and partnerships said in the article. “For us to get involved in a deal, we lean on our first-party data to make that decision.”

“This partnership with the Hearst brands is an interesting combination of performance marketing data, and brands that already have brand equity and customer bases,” Idle Group’s founder and CEO Craig Schmeizer, told Digiday.

Real Simple MEREDITH GROUP

Another classic example — in 2021, Real Simple, a Meredith magazine, announced the launch of Real Simple handbags in partnership with television shopping channel QVC, in

a brand extension inspired by Real Simple’s mission to simplify busy modern lives. “This line was created to help women across the country move effortlessly from the grocery store to the office to their best-friend’s birthday party,” said Liz Vaccariello, the then Editor-in-Chief of Real Simple.

The handbags were a huge success, and they were just one example of Meredith’s slew of licensing and branded content offerings of which it is a pioneer. Inspired by its Better Homes and Gardens magazine, it has a product line that is at more than 3,800 Walmart stores in the U.S. The items range from seasonally driven offerings in all major home and gardening categories to linens, towels and home décor.

Playboy

After Playboy announced back in 2020 that it would no longer be selling print editions of the magazine, many wondered where the brand might go in an era of #MeToo and a

completely different social climate. FIPP reports that since then, the 40-year-old brand has acquired TLA Acquisition Corp in a bid to further expand into wellness, as well as

bolster its brand portfolio, digital commerce, and direct-to-consumer product sales capabilities.

Playboy’s current e-commerce offering includes an online shop with a huge range of branded clothing and other items, and there have been successful collaborations too, such as its Playboy x Missguided collection.

CHALLENGES

Creating branded products can isolate a publisher’s ad partners that operate in those areas and would require some artful navigation. It is also crucial to choose your products and partners wisely as there is no guarantee of success. Building brand extension strategy on first-party data and publishers’ direct relationship with audiences is crucial. As more publishers beef up operations in terms of first-party data collection and segmentation, direct consumer plays of this kind will likely become a highly competitive space

Publishers are builing on their reputation of expertise to offer various classes and courses to their audiences. Interest in online courses offered by MasterClass and Coursera surged during the pandemic years, making this a smart use of journalistic experience and a trend that publishers could exploit. Tie-ups with universities and other digital education companies are also being explored as viable options for publishers and these days there are many innovative ways to deliver these courses.

KEY EXAMPLES

The Financial Times

The Financial Times launched its first newsletter course earlier this year called MBA 101. The free six-week email series, which starts whenever a reader signs up, is aimed at

anyone interested in applying for a Masters of Business Administration. It is written by Global Education Editor Andrew Jack and Content Editor Wai Kwen Chan, and guides participants through the process of applying for an MBA, from choosing the right course to getting funding.

A free newsletter course may not be an obvious starting point for a publication that has one of the hardest paywalls in the industry, Digital Content Next reports, but part of the reason why the FT chose the MBA admissions topic for its first course was because it aligned with their existing successful MBA rankings programme.

Although the top-level rankings are available to view, prospective students can register for a profile to compare programmes they are interested in, as well as see key statistics on diversity, career progression, course tuition fees and more. Signing up to the MBA 101 newsletter course also creates a registration for an MBA rankings profile, which keeps the link between the two products strong.

Ultimately though, Digital Content Next says the end goal is to convert MBA rankings and MBA 101 registrants into full FT subscribers. Because the majority of the target audience for this course are likely to be students already—or soon to become students—each of the newsletter editions also contains a link to the FT’s heavily discounted student subscription.

Emily Goldberg, US Newsletter Editor for the Financial Times, led the new project. “We know that newsletters boost engagement among our readers, and that they’re a really great way to promote retention,” she said, explaining why they chose to go with email delivery. “Since the course is available for free, it has the potential to reach new readers, draw them into the FT and then keep them engaged and involved.”

The Economist

The Economist launched its Executive Education pillar in February 2021 as a growth initiative that would allow it to leverage its journalists’ deep knowledge and understanding of global issues. The education sector itself is vast, and there are many routes publishers could take. Writing for Digital Content Next, Esther Kezia Thorpe notes that The Economist decided to focus on its existing audience, and tailor its courses to highly qualified senior executives. “We’re already catering to the needs of mid-career executives who are upskilling, and that’s our target audience for our courses,” Fionnuala Duggan, Executive Director of Education at The Economist Group Media, told her.

Courses include International relations: China, Russia and the future of geopolitics; Professional communication: business writing and storytelling, and Fintech and the future

of finance. Digiday reported that since the first course was introduced in May 2021, over 900 participants have joined with a 97% completion rate and 96% satisfaction rate. On top of this, 73 countries have been represented with the courses earning well over 1 million in the first year.

The Economist decided to focus on quality over quantity, Thorpe notes in a fascinating piece about what The Economist’s push into education can teach other publishers. Each course runs for an average of six weeks, and requires six to eight hours a week from participants. They contain a mix of writing, infographics, video, audio and links. Each is led by a head tutor alongside a team of tutors who guide students through each week.

Further, The Economist decided to take a guided approach with scheduled start and end dates rather than run on-demand courses because it offered a higher quality experience. Having tutors who can answer questions, stimulate discussion and provide feedback helps participants get more out of the courses, which underpins the value of the four-figure price tag. One key part of the publisher’s approach has been separating the focus of this pillar from the rest of the business. Although there is a great deal of collaboration be ween the departments, their approach is different. “We’re not in the media business,” Duggan is quoted in the article. “We’re in the business of education. But we’ve benefited enormously from all the things that The Economist and The Economist Group has.”

The family Handyman

The American home improvement magazine launched a suite of online classes called DIY University. “More than just your average how-to video, DIY University offers curated online workshops in home repair and renovation developed by experts with easy to understand step-by-step instruction,” the site says.

The Wall Street Journal

In late 2020, the publisher launched its first free, course-style newsletter, the Six-Week Money Challenge, to help people with their finances, followed by a six-week Fitness Challenge with exercises to do at home. Given the success of those campaigns with click rates and bringing in news audiences, the publisher decided to launch another newsletter-based education program. The five-part course on stock investing is written by the columnists of Heard on the Street, The Wall Street Journal’s financial and economic analysis column.

CHALLENGES

It is important for publishers venturing into this area to find a space where they stand out, whether that is because of expertise in a specific field, or loyalty from a particular market or demographic.

When executed well with good partnerships and the right management team, events could account for 20% or more of total revenues for publishers. There is not a forward thinking publisher out there at the moment that isn’t looking for creative ways to leverage their journalists’ expertise and their brand’s convening power to host topical discussions. Though this model seemed to be the most at risk during the COVID years it showed remarkable resilience — several publishers successfully pivot toward virtual or hybrid events and make them work financially as they allowed for participation to be scaled up significantly.

Over two years of successful experimentation with converting offline properties to successful digital ventures, the stakes were raised significantly. The media analyst Mark Stenberg detailed this succinctly in a July 2022 piece for Adweek: “Now, as health protocols allow for the resumption of physical gatherings, publishers are faced with a welcome, if mildly ironic challenge: integrating their virtual offerings back into the landscape of in-person events.” While the success of virtual events had raised expectations for in-person gatherings, Stenberg noted, key strategic elements such as distribution strategies and pricing for virtual tickets remained open questions. A collection of leading industry voices quoted in his piece helped flesh out this idea and they are as relevant, even a year on, while thinking about the future of events:

“People have fundamentally recalculated why they attend events,” said Dan Macsai, executive editor of Time. “The standards have gotten higher.” “To attract paying attendees, physical gatherings need to emphasise all the elements they offer that can’t be replicated online,” Candace Montgomery, senior vice president and general manager of AtlanticLive, the events arm of The Atlantic, also weighed in.

The appetite for networking in particular, the article notes, highlights the opportunity to turn the limitations of in-person events into selling points that justify the high price of admission. “We’ve all been away for two years, so there is more respect for what it means to be in person,” said Stephen Colvin, global chief commercial officer for Bloomberg Media.

EXAMPLES

Semafor

The news website Semafor, founded in 2022 by Ben Smith, a former editorin- chief of BuzzFeed News and media columnist at The New York Times, and Justin B. Smith, the former CEO of Bloomberg Media Group in 2022, was one of the most hotly anticipated new veneers in media. Besides being helmed by dynamic, well-recognised founders it also promised new ways of telling the news and fresh approaches to the business of news.

In December last year, Stenberg reported for Adweek that the publisher was on pace to generate a staggering 30% of its first-year revenue from SemaforX, its experiential business, according to co-founder and chief executive Justin Smith — a percentage the report said will likely increase in 2023 as it expands its portfolio from 15 to more than 40 global events. The article notes that this is partly thanks to its decision to host nearly 12 events prior to launching its newsroom, which officially debuted in October 2022.

“Semafor hosted a private Parisian dinner in September, which was sponsored by the pharmaceutical company AstraZeneca, and in July, it launched its Trust in News franchise, a series of ongoing conversations in partnership with the Knight Foundation that courted controversy for its inclusion of Fox News host Tucker Carlson,” Stenberg writes.

“The publisher has also benefited from the experiential track record and commercial connections of Smith, who began his career launching events and has honed the practice at each successive outpost.”

Time

Time has been running a thriving events business for years — the publisher began hosting its annual Time100 Gala in 2004 and in 2019, added three other events: the Time100 Summit, which accompanies the Gala, as well as Time100 Next and Time100 Health.

After the pandemic hit in 2020, Time suspended all of its in-person events and launched Time100 Talks, a series of virtual conversations between Time staff and Time100 honorees. As inperson events returned in 2022 the publisher continued to experiment with an expanded events slate by extending franchises like Time100 internationally, introducing new series like the Time Impact Awards and expanding its events programming to different regions. As reported by Adweek in 2022, the publisher is developing plans to host Time100 events in Singapore, Ghana and Israel. Time has proved that online gatherings can supplement in-person events — among other things, it has bulked up its video production team so it could turn in-person events like the Time 100 Summit into a multi-camera, premium television production.

In June 2022, Digiday reported that the publisher’s events business was on pace to bring in at least $10 million in revenue for the first time, according to Ian Orefice, president and COO of Time and Time Studios. The business is “projected to grow around 20 to 30% in 2023,” Orefice said in the article.

Forbes

Adweek reported in October 2022 that the business news publisher Forbes has seen revenue from its events division rise by 60% significantly for the year after it transitioned most of its portfolio from a virtual to a hybrid model, according to the publisher. Also according to the publisher: Event partnerships now represent 35% of Forbes’ total advertising revenue.

CHALLENGES

As we outlined at the start, the challenge will now be in blending elements of virtual events into inperson offerings. For two years publishers went through a process of trial and error and that sometimes resulted in wildly fluctuating prices for attendance. “Two years of virtual events, which charged a discounted price or were free, have softened consumer demand,” Brian Quinn, editorial director of events for travel news platform Skift, told Adweek. The pandemic also conditioned consumers to wait until the last minute to buy tickets. A middle ground now has to be found where tickets can be priced up but the benefits of attending in person are really played up and sold.

Producing advertising content for brands is a way for news publishers to make extra revenue with their significant expertise in storytelling. A 2020 report by INMA notes that branded content is a strong strategy for consumers influenced by viral videos, on-demand entertainment, and unique experiences. It adds that branded content can create trust and lucrative relationships between media publishers, advertisers, and audiences when it’s done with an authentic voice, across multiple platforms, and backed by data. The bounce-back of ad markets after a difficult period during the COVID years has been one of the media stories of the last couple of years. As such, though it has its challenges, this would be a particularly good time for publishers to invest in content studios to partner with brands looking for strong campaigns and a more direct connect to high-quality audiences.

EXAMPLES

Vox – Vox Creative

An award winning content studio, Vox Creative has become a one-stop content shop for advertisers. “We are a creative collective within Vox Media that connects brands and audiences through the things that really matter to them. We leverage the technology, insights, measurement tools and influence of our editorial networks to connect brands to a community that’s 125MM strong,” a note on the studio’s website reads.

“From quick-hitting social first programming to premium longform storytelling, the team works closely with partners to connect with audiences wherever they spend their time. In the last year, Vox Creative grew the number of brands with which it worked by 24% yearover- year, expanding the number of brand advertisers it works with on integrated campaigns,” Digiday note as it awarded Vox Creative the prize of the for best content studio at the 2022 Digiday Media Awards. insights, measurement tools and influence of our editorial networks to connect brands to a community that’s 125MM strong,” a note on the studio’s website reads.

“From quick-hitting social first programming to premium longform storytelling, the team works closely with partners to connect with audiences wherever they spend their time. In the last year, Vox Creative grew the number of brands with which it worked by 24% yearover- year, expanding the number of brand advertisers it works with on integrated campaigns,” Digiday note as it awarded Vox Creative the prize of the for best content studio at the 2022 Digiday Media Awards.

The dramatic increase in e-commerce as a result of the COVID-19 pandemic also accelerated publisher’s interest in its revenue potential. Some pandemic trends became lasting habits even post-lockdowns, and online shopping is one of them.

E-commerce would make up 19% of global retail sales in 2022, growing up to 25% of total sales by 2027, according to 2021 predictions by the British communications firm WPP. Their model anticipated that eCommerce sales would be worth $5.4 trillion in 2022, with China and the USA contributing just over half (52%) of this spending. The model also estimates that by 2027, eCommerce sales will be worth $9.1 trillion annually.

“This shift in consumer behaviors is both a challenge and an opportunity for publishers. To succeed in this evolving landscape, media companies need to adapt their content strategies, explore new revenue streams, and prioritise the user experience,” Damian Radcliffe, journalist, researcher, and professor based at the University of Oregon, writes for What’s New in Publishing.

“The move to frictionless shopping, and mobile commerce, for example, are dimensions that consumers expect when they buy products online Publishers risk missing out if they don’t have this functionality embedded in their own eCommerce propositions,” he adds.

“By assuming a bigger role in the customer journey, a publication wants to get closer to the transaction and wants to have a higher take on the transaction,” says INMA Researcher-in- Residence Gregorz Piechota. “Publishers are seeing they really can’t make a lot of money with advertising because there is too much content available on the

Internet. But we have good relationships with customers, and we can upsell them with products,” he adds.

There are various models through which publishers can take advantage of the e-commerce boom. The most common is through affiliate marketing — sending customers to an outside link and earning the media company a percentage of the revenue from any purchase made. Key to making this model work is investing in a quality product review section that customers can trust as being unbiased.

EXAMPLES

The Independent

The Independent’s Indy Best section has continued to expand, in part due to the COVID-19 era shopping craze. The site, which offers product reviews and buying guides, “doubled the size of the team… to 16 people, including ten full-time editorial roles, during the pandemic,” Press Gazette has reported.

“This is a long-term commitment, and was before the pandemic,” the Independent’s managing director Christian Broughton said. “We are accelerating as fast as we can to grow

this and I don’t anticipate it’s going away.”

In 2022, the publisher launched a new, integrated shopping service that allows readers to purchase products from editorial reviews on The Independent website, without being linked out to external sites. This is a great example of an innovation that keeps readers on the site.

As part of the initiative, the publisher has partnered with checkout technology company Bolt, who raised $355 million last year in a Series E round managed by BlackRock. Bolt is led by CEO Maju Kuruvilla, a former Amazon exec, and the company’s decentralised tech allows consumers to checkout quickly “without the needless restrictions that Amazon, Shopify and Stripe use to trap people in their ecosystems”.

Future PLC

Future PLC drove nearly $1 billion in e-commerce sales in 2020 and that growth has carried over into 2021 and 2022 The U.K. media company owns brands like Tom’s Guide, Cinema Blend, Golf Monthly and Marie Claire.

According to Digiday, Future sold $960 million in sales order value (or SOV, the gross value of a product sold via Future’s content) for affiliate partners in 2020 via Hawk, its proprietary price comparison platform that launched in 2022 Hawk automatically identifies products and vendors that the company has an affiliate relationship with and embeds those links in product review articles, so that readers can see prices and retailers next to products mentioned. Hawk works with big retailers like Amazon, Walmart,

Best Buy and Target, as well as smaller affiliate partners.

The number of total transactions driven by Future grew by 109% in the U.S. from April 2020 to April 2021. Future declined to tell Digiday what share of money from each transaction the company keeps. Commission rates can vary widely by product and retailer and can range from single- to doubledigit percentages.

“We are able to produce and display real-time price changes for different retailers, for millions of different products and services,” Jason Webby, chief revenue officer for North America at Future PLC, was quoted in the Digiday article.

New York times– Wirecutter

Wirecutter is a product review site acquired by The New York Times Company in 2016 that is one of the pioneers in an affiliate marketing strategy built on product reviews. It focuses on writing detailed guides to different consumer product categories and offering recommendations on the best products. Since it generates revenue from affiliate commissions, Wirecutter is less reliant on traditional advertising.

Wirecutter was started in 2011 by editors who were intent on helping solve readers’ problems and giving them recommendations for retail purchases across multiple categories. “Compared to competitors, we are not in the business of worshipping products. We are in the business of helping users find out what is worth paying for and what is the best product for the price. We employ a journalistic, methodical process to uncover the right information,” Leilani Han, Wirecutter’s Executive Director of Commerce, told Digital Content Next in June 2022.

“We make a recommendation – not just a review. We communicate in way that is relatable and direct – not academic. Wirecutter cuts the time and stress of shopping by providing direct and actionable buying advice. We knew if we took care of the reader experience and prioritised their trust in us above all else, the monetisation follows.”

Gannett – Reviewed In July 2021, The Wall Street Journal reported that newspaper publisher Gannett Co. had doubled the number of staffers at its product-review website called Reviewed over the past 18 months, taking direct aim at Wirecutter and BestReviews.

“The push comes after e-commerce surged and ad spending declined for a time during the COVID-19 pandemic, increasing pressure on media organisations to hunt for new revenue streams and to shore up their digital businesses,” The Journal notes.

“Top-line revenue has grown 50% every year for the last three years, and our projections for 2021 are around the same percentage,” said Chris Lloyd, general manager of Reviewed, adding that the site’s staff had increased to 80 full-time employees.

The Wall Street Journal