26 Jul A Primer on Paywalls

Digital subscriptions were already an essential component of journalism’s business models pre2020. But as with many things, the pandemic took a trend already evident in the world of media and supercharged it. In a year of unprecedented challenges, with advertising revenue collapsing, print sales under significant pressure and events businesses having to cease, at least temporarily, a spike in subscriptions emerged as the one bright spot for publishers as interest in news spiked and audiences were willing to pay to get it from trusted sources. The digital business platform Piano which provides subscription services to major publishers around the world reported a median increase in active subscribers of nearly 58% from the end of 2019 to the end of 2020 among 320 sites surveyed.

Three prominent publishers, El País in Spain, El Tiempo in Colombia, and News 24 in South Africa are amongst those who started their paywall journeys in the midst of the pandemic. Paywalls may now seem like a foregone conclusion given this boom, but it was only as far back as 2018 that publishers as big as Wired and Bloomberg eschewed this approach. If 2020 accelerated the widespread adoption of paywalls, 2021, and subsequent years, could see paywall strategies become more refined in order to ensure that the bump translates to sustainable revenue.

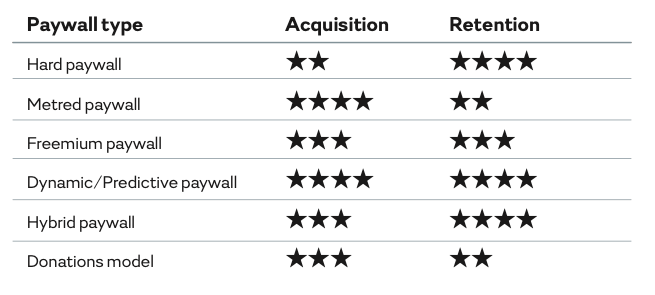

A key to this will be capitalising on the lessons learned in 2020 where publishers managed to broaden each stage of the subscription funnel — trading content for registration details, tightening paywalls to expose readers to offers and experimenting with both discounted trial offers and long term offers. At the same time, publishers with paywalls also lowered restrictions on content around big news events like the pandemic and even allowed free access for certain periods, gaining invaluable information about readers in order to understand which of them are more likely to subscribe, as well as first party data that can prepare them for cookie-less future. A cumulation of these learnings informs the best paywall practices today, as we will document in this chapter. The key question for publishers to keep in mind, as we navigate into a post-Covid world, is this: is your reader revenue model built for acquisition or retention?

The Hard Paywall

A hard paywall prohibits visitors from viewing any content without a subscription. Conventional wisdom on this model states that it’s most viable for established titles with heavy brand loyalty and niche publications that dominate their area of coverage. The risk of a hard paywall strategy is twofold — by not offering potential subscribers some content for free, converting them to subscribers becomes difficult. Second, a hard paywall significantly reduces web traffic, which could hit advertising revenues that are dependent on page views. However, some publishers have made this model work, betting that if the content is premium enough, there is no reason to offer it for free.

The Economist (UK)

The Economist is an example of a publication which has moved to a hard paywall over time, after experimenting with various levels of access. In 2012, visitors to the website were able to access five articles, with five more allowed if they registered their details. Even in 2017, the company was talking about turning social visitors into subscribers to make up for falling print ad revenue. By 2018 however, the strategy had changed.

Access was reduced to one free article, with three allowed in return for registration. By 2019 it had moved to a hard paywall where readers could see just two paragraphs before being asked to register or log in. “We definitely saw a big increase in registrations as a result of forcing people to make this decision to sign up. We also saw an increase in conversion rates, and this signalling to us that, yes, there is an upside to doing this, at least a short term upside to doing this, The Economist’s Head of Insight and Data Science, Adam Davison, told What’s New in Publishing in 2019.

Additionally, once people registered, they went on to read and engage more on the site. This offset the bounce rate from those who did not register and left the site. The move to a hard paywall has paid off for the company. In June this year, The Economist reported growth, from 90,000 to 1.12 million in 2021, its largest ever increase in a single year.

Other examples

The Times (London) introduced a hard paywall in 2010 and initially saw a 90% dip in visitors. However, It has since managed to recover a large portion of its lost audience over time and through the quality of its reporting and reputation. It now boasts over half a million daily readers and hails the success of its paywall strategy.

ALSO SEE The Financial Times (UK)

The Metered paywall

A metered paywall allows users to access certain content within a specific period. For example, a publisher may allow users to read five articles every thirty days. When the fifth article is read, the reader will be presented with a paywall, and all other content will remain locked until the time period ends. This is a popular model with publishers because it doesn’t alienate infrequent readers or deter page views and their resulting ad revenue. It is also generally more popular in the U.S. The metered paywall option also allows publishers room to grow and understand the various ways in which users can be converted to subscribers. The most famous example of a metered paywall is The New York Times. It’s evolution — from granting the reader 20 free articles when it launched in 2011 to the five today — tells the story of the balance successful publishers now seek between growing the reader base and forcing conversion. Still, research from Harvard’s Shorenstein Center and Lenfest Institute found that most publishers are too generous in the number of free articles they offer.

El País (Spain)

Subscription models came relatively late to Spain. After debating for many months which model to implement, the country’s biggest newspaper introduced a metered paywall in May 2020. Two months into the pandemic, El País started giving readers access to as many as 10 free articles before asking them to pay. The strategy was a runaway success with the newspaper reporting earlier this year that it has more than 100,000 digital subscribers, acquired in just 11 months. Many readers chose a monthly subscription during the first few weeks of the metered paywall, but more have signed on to yearly subscriptions when asked to renew. About 25% of its digital subscribers are located outside of Spain, which may indicate it has more potential to grow in Latin American markets.

Wired Magazine (USA)

Tech magazine Wired.com launched its metered paywall in 2018 which allows readers to access four free stories a month before they’re asked to subscribe. The introductory offer is a print + digital subscription for $10 for the first year, though the price goes up to $29.99 for the next year. Wired is a good example of a publisher running experiments to test what leads to reader conversion. There were some surprises in the stories that induced people to subscribe (not all of them were long form pieces that generated a lot of traffic, as the editorial team expected).

Second, Wired found that people were more likely to subscribe if they were referred from one of Wired’s newsletters rather than via search or a social media link. That prompted them to launch a variety of newsletters, tied to specific sections of the site. And finally, another finding was that offering a free gift along with the subscription didn’t work. At the end of the first year after launching the paywall, Wired increased the number of new digital subscribers by 300%, according to Editor-in-Chief Nicholas Thompson.

GateHouse Media (USA)

A variation on the metered approach is used by GateHouse Media, a publisher of local print and digital outlets in the U.S. which merged with Gannett in 2019. GateHouse’s paywall practice is called a “two-five meter”: A consumer can read two articles for free, then is prompted to become a registered user, which then unlocks three more free articles for a total of five free stories. The reasoning is that a registered user is four times more likely to become a digital subscriber than an anonymous reader.

ALSO SEE The New Yorker (USA)

The Freemium Paywall

This model has become one of the most popular paywall strategies, allowing free access to much of a brand’s content, while placing a smaller crop of articles behind a premium paywall. Deciding which articles go behind the paywall is a value call from the editorial team. Recent research suggests that this type of paywall is currently the most popular — in 2020, INMA studied the 569 news websites with the declared highest usage that were listed in the Reuters Institute Digital News Report, finding that 47% offer a freemium model. While it was previously more common in Europe there are several recent examples of American publishers shifting to this approach like The Gannett group.

This is no coincidence perhaps, and is a sign that publishers thinking about reader engagement is evolving away from the metered model which assumes that each story’s contribution toward a readers subscription is the same. Instead, Freemium (and hybrid and dynamic models which we discuss later) lets publishers think about how each story can best contribute to the business by driving subscriptions, bringing in new readers or driving engagement. A report from the data analytics firm Chartbeat, notes that like metered paywalls, implementing this model requires organisations to be open to frequent iteration and experimentation, and deeply committed to understanding their target market.

Helsingin Sanomat (Finland)

Finnish newspaper Helsingin Sanomat moved to a freemium model in 2016 after it found that its metered paywall approach was not encouraging younger readers to sign up. These readers were engaging with the content but were not paying because it was easy to bypass the paywall with workarounds like the incognito mode, social media, and other means. They would only pay, the company figured, if they could not get to the content without paying. To solve this problem, they introduced hard paywall articles they call diamond articles — hand-picked, high-quality feature stories. Such stories are even promoted on social media, marked with a diamond emoji, to showcase what kind of content is available to subscribers. The strategy helped Helsingin Sanomat grow its digital-only subscriptions 37% year-on-year and digital-only subscriptions by people under 40 by 60%.

News 24 (South Africa)

Online news outlet News 24, introduced a freemium model during the pandemic in July 2020, after studying various international models to see what would work best for the South African market. Editor-in-Chief Adriaan Basson told The Media Online that the company was “mindful” that many readers might not be able to afford the subscription service while others could be resistant to paying for something they had received for free. They felt the freemium model, where a lot of content would remain free, was the best fit. Continuing to provide breaking news for free is the hallmark of News24,” Basson said, explaining that readers would be asked to pay for the “extra stuff” like investigative stories and podcasts.

ALSO SEE Business Insider (USA), The Daily Telegraph (UK)

The Timewall

As the name would suggest, this is a variation on the freemium model that uses time as the decider of when to go up or down. When implemented correctly, and with enough testing, this strategy can increase the frequency of visitors who are not yet subscribers, therefore increasing the site’s retention, while incentivising the audience to keep checking back for new news.

MittMedia (Sweden)

Swedish media group MittMedia, which owns dozens of regional and national news brands, adopted the timewall strategy in 2019 to strike the balance between acquisition and retention. Their content is free for the first hour after it is published after which it becomes premium. The method ensures that readers are incentivised to come back often to the website and the user experience is ‘gamified’ in a sense. The timewall strategy has helped the publisher increase subscriber conversion by 20% and it’s something that could be easily adopted by other publishers as well. In addition, Twipe Digital Publishing has reported that it took the team at MittMedia just two weeks to build and launch the timewall, Twipe Digital Publishing reported.

Dennik SME (Slovakia)

Slovakia’s Dennik SME has also tried the tactic of making content free, but only for the first hour after publication on the site, an INMA report notes in 2020. This idea was then made into the heart of a TV ad campaign with the tagline, “In one hour, everything is different.” The report notes that the strategy encourages readers to stay on the site and check it every hour, establishing a habit. People then see enough advertisements in this time to make it worth SME doing it. This tactic was inspired by the Mittmedia.

ALSO SEE MadSack (Germany), BoiseDev (USA)

The Dynamic Paywall

A dynamic or predictive paywall is a model that incorporates an extra layer of ‘intelligence’ over any of the previous types of paywalls. This is a data-focused strategy that finds the people most likely to subscribe and then gives the publisher the ability to turn up or down the dial on the paywall. Those identified as high-propensity users may hit a paywall pop-up earlier than others, or the publisher might adjust the type of offer that appears when the content is gated and the user is asked to subscribe.

The Globe and Mail (Canada)

At the very cutting edge of this approach is the artificial intelligence system called Sophi, developed by Candian publisher The Globe and Mail. Sophi powers a fully dynamic, personalised real time system that decides when, or even if, to show a paywall. The unique thing about this paywall is that it knows when to give up rather than alienate visitors. Here’s how Sonali Verma, senior project manager at The Globe and Mail, described it at the Online News Association conference earlier this year: A reader who reads mostly general news and recipes might be less likely to subscribe than one reading a lot of business-related content. Still, Sophi might present this general news reader with a paywall.

If they don’t reach for their wallet, the model won’t hit them with the same message again. Instead, Sophi might pivot, and try asking the reader to register with an email instead. Sophi uses analytics to make decisions that balance the potential for ad revenue against the potential for subscriber revenue. Some readers might never encounter a paywall (Verma mentioned a hypothetical visitor who primarily reads car reviews — a strong source of ad revenue) while others might see one every time they visit the site. The Globe and Mail has credited Sophi with helping it achieve a 51% increase in subscriptions as against its old paywall which was a hybrid approach. In April the company reported that it had 170,000 digital-only subscribers.

Wall Street Journal (USA)

The Wall Street Journal has had a paywall since 1997 and has constantly worked to refine it. Its dynamic paywall model can be described as deliberately porous, testing different ways for nonsubscribers to sample its stories.

This system classifies visitors to WSJ.com into three groups based on their likelihood to subscribe (cold, warm, and hot) and it leads to the paywall experience they receive. People more likely to subscribe will hit a hard paywall immediately while others may receive an offer like a seven-day guest pass to help increase the likelihood of subscription. The Journal has also experimented with 24-hour guest passes for nonsubscribers when readers access a story shared by a subscriber or a Journal staffer.

This year, as part of its new brand push it held an “open house” on May 20 in which dropped the paywall on its site to let all content be accessible for free for the day. Schibsted (Norway) Norwegian publisher Schibsted’s subscription-purchase prediction model was developed by the company’s data science team and has been in use at four of the group’s Norwegian sites since last year: national newspaper Aftenposten and regional titles Bergens Tidende and Stavnager Aftenbladet.

The model was first tested first at Aftenposten. It predicts how likely readers registered and logged into one of these sites are to buy a subscription, based on their browsing behavior and other activities. It then advertises offers to them differently

ALSO SEE Neue Zürcher Zeitung (Switzerland), Svenska Dagbladet (Sweden)

The Hybrid Paywall

This system combines aspects of metred, freemium and even dynamic models. So, while a certain segment of premium content remains locked, free content remains available. However, these free articles will also become locked dynamically when a user reaches a certain level of engagement.

Dagens Nyheter (Sweden)

The Swedish daily dagens Nyheter, owned by the Bonnier group, started thinking seriously about its paid content strategy in 2015. Now, it has a hybrid of three different paywalls: The first, a meter where readers can access three articles a week, accounts for 10% of the title’s conversion to subscribers. The second, a premium model where two or three daily lifestyle articles are for subscribers, converts 30% of prospects. The third, introduced in early 2017, is a more dynamic, dashboard model.

“We see what kind of content works, keep it open (freely available) for three or four hours, and if we have a lot of high external traffic and direct traffic, we’ll put the content behind a paywall,” Martin Jönsson, Head of Editorial Development at DN, told a WAN-IFRA conference. According to the publisher, this accounts for 60% of its conversion rate and an average 50 articles per week hit these criteria. This layered model, Jönsson said, helps the newspaper focus not just on acquisition of subscribers but how to figure out the right offer and the right pricing in order to get people to stay on for a long time. DN saw a surge in subscriptions during the pandemic when mon-subscribers were given free access to the DN website at different points, in return for their email addresses. It led to nearly 200,000 registrations, around 25% to 30% of which became paid subscribers. The Financial Times reported in September 2020, that DN was on its way to increasing operating profit by about 50% to nearly $20M, the publisher’s best performance since the 1990s.

ALSO SEE Kauppalehti (Finland), Denník SME (Slovakia)

The Donations Model

A growing number of publishers are turning to models that are free but ask the reader to volunteer a donation. This could be a payment in exchange for a membership package with additional access and benefits, as part of a non-profit news model or as an effort to keep news free so that readers who can afford to pay can underwrite those who cannot.

The Guardian (UK)

The Guardian has for years pioneered a system of combining contributors with subscribers. By the end 2020, following a surge of interest and support during the pandemic, Press Gazette reported that it had more than one million paying subscribers and regular contributors. This includes 352,000 subscriptions to its paid-for apps and tablet editions, and 548,000 recurring contributors – including people categorised as members and patrons. It also received 530,000 one-off donations as of figures reported in October 2020, On its ‘Support the Guardian’ option on the website, the newspaper gives readers the option to contribute £4-16 monthly, £75-500 annually, or £35-280 as a one-off donation. Or readers can choose any other amount under these heads to contribute. Alternatively, the purchase of a digital subscription offers readers access to the Guardian Daily App, The Guardian Live app and ad-free reading on The Guardian’s website.

ALSO SEE El Diario (Spain), The Wire (India)

Conclusion

In charting out the paywall spectrum and the different approaches that publishers are taking toward reader revenue we can see some major trends. The first is that paywall models are increasingly becoming more adaptive and personalised. Whether it’s fully AI driven or uses other reader behaviour metrics, there is an increasing recognition that there is no one size fits all strategy. At the same time, while some publishers have found success with a hard paywall model, most are shifting toward variations of a freemium model that understands the differing values of each story’s contribution to the business rather than a standard metred approach. There is also a broad consensus that some content should remain free in order for subscribers to grow.

As Chartbeat notes, building paywalls requires close collaboration and alignment from several teams in a publishing organisation in order to understand the number behind reader engagement but also what types of content or products drive people to subscribe. So even as we recommend that all publishers should adopt this approach, we also reiterate one of our key messages in recent years: before getting caught up in how to charge, it is first essential to ensure that you have a unique, quality product that is worth paying for.