23 Oct SEE, WANT, BUY: MEDIA COMPANIES AS RETAILERS

You could call this the funnel-less sales process. No top, middle, or bottom of the funnel. It all happens at once.

E-commerce and mobile commerce (m-commerce) together enable both the instant creation of a need and then the instant satisfaction of that need. Media companies’ bricks-and-mortar pop-up stores do the same thing.

The media company as a retailer business model can also serve every level of the sales funnel. Media companies whose trusted editorial teams give readers expert reviews of products fulfil a consumer’s need for product-purchase information at the beginning, middle, and end of the funnel.

In both cases, the success of publishers’ e-commerce and m-commerce initiatives proves the power of a media company to deliver results to partners and advertisers while also creating two new and potentially robust revenue streams:

1) Direct or commission revenue from product sales , and

2) Advertising revenue from brands who purchase native ads and branded content around the service journalism.

Media companies that do not take advantage of this retailer business model, especially in terms of e- and m-commerce, are missing out on a fast-growing segment of consumer spending.

In 2017, e-retail sales accounted for 10.2% of all retail sales worldwide. This figure is expected to reach 17.5% in 2021, according to market research company eMarketer.

As e-commerce sales continue their meteoric growth, mobile is grabbing a larger market share, with smartphone-enabled purchases set to grow from $122 billion in 2015 to nearly $319 billion by 2020, according to a new report from Javelin Strategy & Research.

A greater number of overall e-commerce purchases will come from smartphones, according to Javelin’s estimate that m-commerce purchases will make up 49% of total online retail commerce in 2020, a significant increase from 29% in 2015. An indicator of the future of m-commerce is the Asia-Pacific region.

That region is the global leader in m-commerce because almost half of Internet users there purchase products via mobile phones, according to the Asia-Pacific M-commerce 2017 Report by international market research company Research and Markets. South Korea is cited as a top mobile shopping player where m-commerce exceeded 50% of online retail sales between 2016 and 2017, according to the report.

So who are the stars of the media-as-retailer business model?

Enabling e- and m-commerce using media expertise

For fifty years, New York Magazine gave its print readers shopping recommendations. But when the company moved those tips online, a new revenue model presented itself.

Instead of just the recommendations, New York’s tip service, The Strategist, now empowers its readers to act immediately on the information for instant gratification.

The Strategist, with three editors, a slew of freelancers, and some staff-written recommendations, produces three stories a day which it then posts on New York Magazine sites such as Select All, Grub Street, and The Cut. Taken together, those sites drive the bulk of New York Magazine’s recommendation traffic.

In choosing items to review and recommend, The Strategist editors focus on products people are searching for, plus unique items the editorial team encounters themselves.

The strategy has succeeded beyond expectations. From its cut of each sale, New York’s affiliate revenue from product sales tripled from 2017 to 2018, according to Camilla Cho, New York’s executive director of strategy and business development, speaking to Digiday.

One piece of advice from Cho: Don’t port your e- and m-commerce efforts over to pictorially focused social media like Pinterest or Instagram. The search-driven commerce strategy does not extend to those programs because compelling photography is not available (“a straight-up shot of a toothbrush or nail clippers is not something that’s going to get a lot of traction,” Cho said), and those sites, while perhaps generating lots of followers, don’t lend themselves to generating conversions.

“I’d be ecstatic if we got hundreds of thousands of followers on our Instagram account,” Cho said. “But if it doesn’t convert to revenue, it doesn’t matter.”

Tapping into convenience

Meredith has proven that media companies have a leg up on brands in the retail market. Publishers already produce trusted content, which brands cannot, and now the media companies can also provide a level of convenience that brands also cannot match.

In March of 2018, Meredith guessed that readers using its recipes might enjoy the convenience of buying the ingredients for those recipes online and having them delivered to their door. Meredith partnered with eMeals, a paid menu-planning app, to offer recipes provided by editors of Better Homes & Gardens, Eating Well and AllRecipes. Readers click to buy the ingredients through grocery stores or delivery services, and the three publishers share in the subscription revenue.

Picking up on that success, Meredith partnered in the fall of 2018 with AmazonFresh in the US by integrating the service into some recipes of its AllRecipes meal-planning section.

After making individual recipes commerce-enabled, Meredith then really ramped up its food-related commerce revenue by putting individual recipes into meal plans which become the bulk of a family’s shopping list for a full week.

Meredith wants to integrate e-commerce options “seamlessly and natively” into more of its content to make it easier for people to buy things “and give them a great experience on the back end,” Meredith VP and GM of Shopper Marketing Corbin de Rubertis told Beet.TV. “We really try to weave [e-commerce] into the [content] experience itself’” he said. “When you’re looking at a recipe, for example, you should be able to see the ingredients from local stores or Amazon Fresh.”

The weaving of content and commerce results in “a discreet button” at the bottom of a recipe. “You can push the button and all that stuff goes into the cart and you’ll have it on your doorstep that afternoon.

“Then we also work with the brands, because the brands are often positioned inside the retailers,” de Rubertis said.

“We want to make sure there’s a place for them as well.” Meredith will work with both at once; for example a L’Oréal skincare product that can be purchased online at Target.

To serve the brands in another way, Meredith places relevant products adjacent to its editorial content. A recipe in Better Homes & Gardens might be accompanied by suggested cooking utensils.

The shoppable recipes introduced in 2018 weren’t Meredith’s first venture into e-commerce, but together with smaller earlier ventures, e-commerce now constitutes nearly 25% of the company’s food sites’ digital revenues, according de Rubertis.

Meredith follows its own advice to brands: Promote, promote, promote.

The company uses its own marketing tools to promote the new e-commerce opportunities, including content marketing, social promotion, and full-page ads in the print editions. “We’re acting in concert with our overall strategy of trying to develop recurring revenue streams from readers,” SVP of Consumer Revenue Andy Wilson told Digiday.

“As long as it’s relevant and useful, contextualised and appropriately targeted at the audience, we believe it’s part of the content in a lot of ways,” he said. “It saves the consumers from having to go off to retailers’ sites sometimes and kind of ping pong back and forth. This way, they get the inspiration and they can act on it immediately.”

Leveraging the retail play with branded content to increase revenues

Meredith uses its food-related e-commerce to generate advertising revenue as brands buy ads around the content that includes their products.

Advertisers can run branded content in the recipes section or sponsor the recipes. An olive oil company can pay, for example, to become the specific olive oil listed in the ingredients.

That strategy seems to be working very well. According to de Robertis, 80% of consumers use the sponsored ingredient. This revenue stream represents a new source for publishers as the money comes from brands’ shopper marketing budgets which had historically been spent on coupons and physical media heretofore unavailable to publishers.

BuzzFeed, too, has leveraged its product-creation partnerships with brands into increased advertising revenue.

In 2018, BuzzFeed partnered with Macy’s, Scott’s, Maybelline, and Bloomscape to create branded products and then BuzzFeed up-sold those partners into both display and branded content advertising.

E-commerce on social media

Snapchat Discover publishers used 2018 to test e-commerce on the social media platform. Users were presented with products in the Discover store and, with a swipe and click, they could instantly buy the product of their choice. In mid-2018, Snap was reported to be giving 100% of the revenue to the publishers.

The old-fashioned retail model: Bricks and mortar

Here’s a good example of something old being new again. Several media companies, including digital natives Tastemade and Vice, have opened their own bricks and mortar operations.

Tastemade, a digital video network, helped two of its network content creators launch their own real-world cafe in 2016 in a building adjoining the network’s studios. The Bondi Harvest cafe was so successful that Tastemade then licensed its brand to a Brazilian cafe operator and ran a pop-up bakery in Tokyo sponsored by Panasonic.

The cafes are equipped with large-screen TVs playing videos of Tastemade network food shows, reinforcing the connection between the network and the cafe.

“We’re seeing successes in the places we’re testing and think that could lead to better opportunities,” Tastemade CEO Larry Fitzgibbon told Digiday. “We’re certainly excited about the marketing value of the cafes, but also we think it’s an exciting potential revenue line. An attractive aspect of the licensing models is the margin. It has very high-margin opportunities.”

Vice also got into the bricks and mortar act with a branded food court at a new three-million-square-foot shopping and entertainment complex in the Meadowlands in New Jersey in the US.

Named after the Vice foodie site, Munchies Food Hall features 18 vendors plus a stage where Munchies content teams can shoot video of chefs doing demonstrations. Revenue will come from a brand licensing fee plus royalties based on the amount of revenue the food court generates.

Some legacy media companies have also experimented with bricks and mortar, including Vogue Germany. In late 2018, the publisher opened a temporary pop-up in Metzingen Outlet City which spotlights emerging German designer labels.

The 1,000-square-foot store, in Metzingen Outlet City, is the magazine’s first independent retail operation and will be open for five months. The pop-up is designed to highlight Germany’s emerging design talents, including a curated selection from former participants in the young designer showcase Vogue Salon, but will also include established German brands such as Talbot Runhof, Iris von Arnim and Zazi Vintage.

To set the pop-up apart and accentuate the magazine’s expertise, the store offers shoppers with smartphones a variety of interactive and augmented reality features, including videos of the designers’ runway shows, audio messages from the creators, and in-depth information about the designers and their creations.

Text-message e-commerce

Nothing is surprising anymore, so a media company conducting m-commerce via text messaging seems like just the next logical iteration of the retail business model.

Global lifestyle media publisher Pop Sugar launched a free pay-by-text service called Must Have It in 2017 and a year later was claiming 20,000 subscribers.

Users sign up on PopSugar’s website and get texts twice a week on average. Each message features a photo and description of the item. Users simply reply with a “Yes” to order the item and, presto, the item arrives at their door in five business days.

The selection of MustHaveIt items ranges from clothing to food and housewares. The appeal is often that the items are discounted, but some are designed to be impulse purchases. In either case, items move quickly. For example, an item from RxBars, a protein bar manufacturer, sold out in just half an hour. A free makeup item from Kat Von D also sold out quickly,

More than 90% of the MustHaveIt featured products are from advertisers; suggestions from the editorial staff constitute the other 10%.

Running the service requires a five-person team based in San Francisco, the same team that runs PopSugar’s subscription box service. As a matter of fact, the MustHaveIt team used the list of subscription box subscribers to give the text-message app a jump start. That approach worked famously: Forty-one per cent of those getting the subscription box signed up for the MustHaveIt service.

Seamless retail via print

Not all e- and m-commerce begins online.

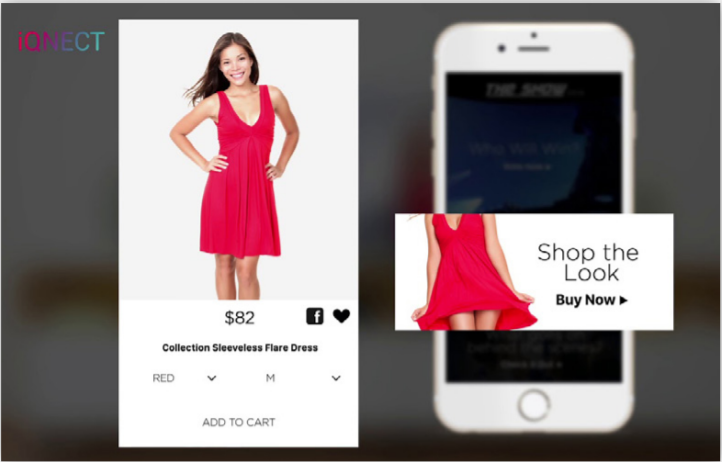

In Thailand and Singapore, three regional magazines — Thailand’s Image and IN and Singapore’s Esquire Singapore — and four international titles published in South East Asia — Her World, Maxim, Madame Figaro, and Attitude — started offering visual search and mobile commerce to readers of their print products.

Readers of those titles download an app from Singapore-based visual search start-up and, by pointing their mobile device at a page or image in the print magazine, they get coupons and other offers and instantly buy the product without leaving the app.

“The aim was to bring offline media to the online world, allowing magazine readers to have instant shopping and other experiences using mobile devices,” iQNECT COO Niamh Byrne told FIPP. Byrne said the success of the technology and its adoption was proof that print is not a dying medium.

“Visual search acts as a bridge between the sumptuous tactility of print media and instant responsiveness of mobile commerce,” she said. “The technology enhances readers’ magazine experience by connecting them with content and mobile-commerce options related to what they are reading.”

For publishers and brands, this means the point of inspiration and point of sale becomes “virtually indistinguishable, thus lowering drop-off rates and raising the return on creative campaigns,” Byrne said.

“Visual search technology captures the critical moment when peak consumer interest is met, providing instant additional product information and the ability to click ‘buy’ within a single app.”

E-commerce sales in Thailand alone will grow from US$10.9 billion in 2017 to $88.1 billion in 2025, a growth rate of 33%, according to a recent study by Google and Temasek, an investment company headquartered in Singapore.

A similar visual search app, Amazon SmileCode, works for InStyle magazine’s print edition.

“The millions of women who come to InStyle every day don’t just want to be inspired to buy, they expect automated commerce — that’s modern shopping,” InStyle Publisher Laure FrererSchmidt told MediaPost.

With Amazon SmileCodes on pages throughout the magazine’s October 2018 pages, InStyle readers hover over the code to immediately put the related item in their shopping cart. The transaction is especially smooth because Amazon already has the user’s information.

By including the codes, InStyle manages to expand and deepen audience engagement, drive sales for its advertisers, and increase both ad revenue and affiliate revenue. Another media company, Good Housekeeping, is also using SmileCodes, but not in their print magazine.

Good Housekeeping opened its first pop-up store in the Mall of America in Minneapolis, Minnesota in late 2018. Every one of the 40 items in the store was available via a SmartCode. By using SmileCodes throughout the store, Good Housekeeping avoided the expense and hassle of buying and managing inventory.

One sample of each item did the trick. Visitors simply scanned the barcode-like image on the sample and it was loaded in their virtual shopping cart. Good Housekeeping also avoided the headache of fulfillment as Amazon covered that function. Good Housekeeping benefited from consumers’ trust and familiarity with Amazon, eliminating the sales-depressing friction involved in getting consumers to set up a new online financial relationship.

Another media company, Clique’s Byrdie, also made use of Amazon’s QR codes in a pop-up store in Los Angeles. The use of the codes at its summer Byrdie Beauty Lab pop-up reportedly resulted in conversions going through the roof.

CAUTION: Amazon partnerships = minimal profit and data loss

While working with Amazon removes many headaches (inventory, purchasing software, fulfillment), there is a price to pay: Minimal return (Amazon’s highest commission is 10%) plus the loss of valuable customer data and relationships.

There is also some lingering skepticism about the effectiveness of QR codes as critics maintain that few people use them.

That’s not the view of analysts at Juniper Research, however. Juniper recently released a study projecting that 5.3 billion QR codes would be redeemed by 2022, up from 1.3 billion in 2017. And while it remains an unproven technology in a rapidly shifting retail landscape, some observers see wisdom in partnering with a company that most people are familiar with.

“Good Housekeeping promoting this [Smile Codes] only works in Good Housekeeping’s favour,” Melissa Gonzalez, the founder of the retail popup agency Lion’esque Group, told Digiday. “A lot of people have the Amazon app. They trust Amazon.”

Mission-related retail revenue

If your mission is to be THE most trusted source of information about automobiles, it’s not entirely nonsensical to also be a purveyor of automobiles.

That’s exactly what UK-based media owner Dennis has been doing since 2014. After purchasing BuyACar.co.uk in 2014, Dennis has built the business to the point where its 2018 auto sales made up 40% of the company’s revenues.

While the first year sales were modest (US$525,000), subsequent years have been anything but. In 2018, car sales revenues were US$81 million and the company projects US$131 million in revenues in 2019.

The car business is not a minor undertaking. Dennis employs 65 at BuyACar, including 25 salespeople. Content on the site is provided by two full-time writers plus reviews from the Dennis auto sites such as CarBuyer.co.uk and AutoExpress.co.uk. Dennis is not sitting on its laurels. The company plans to expand internationally through licensing.

Intriguingly, most of the revenue from the auto operation comes not from the sale of the cars (for which Dennis gets a cut) but from the sale of add-on packages such as financing services. That opens up even more revenue opportunities by creating new add-on products and services.

Selling your own stuff

If a media company really, deeply knows its readers, it knows what they most deeply need or want.

Hearst looked around its readership and decided that one thing their readers really needed was (are you ready for this?) an interactive, pink yoga mat.

Seriously.

The mat, named the Backslash Fit, includes an Alexa function that guides its users through yoga poses and routines, all created in-house by the editorial staff of Women’s Health.

To get to the point of production of Backslash Fit and other products, the 15-person Hearst product studio team works with Hearst brand editors to both conceive products ideas and test and improve them. The studio team also analyses the top-performing stories on all of the Hearst lifestyle brand sites and in search results.

Finally, the team reviews product sales from the Hearst affiliate commerce business. Unlike other manufacturers, Hearst comes to retail with a leg up.

“In order to get maximum communication, exposure, and operating leverage, brands need to get more content in their consumers’ hands,” Richard Kestenbaum, a partner at the investment banking firm Triangle Capital, told Digiday.

“There’s a big opportunity to capitalise when they [Hearst] own both the media and the product.” So, if you are a consumer magazine media company and the niches you cover involve products and services, you could be looking at a substantial new revenue source by adopting the media as retailer business model.

This article, along with many many more is available in full, within the pages of our Innovation in Media 2019-2020 World report, available for purchase in print or digital edition.